Subsidy cuts and new taxes are expected to push up Qatar’s inflation modestly to average 2.8% this year and interest rates are set to increase by 0.25% this year, according to BMI, a Fitch company.

Forecasting a slight acceleration in Qatar’s inflation over the coming quarters, it said “as the government has removed long-standing energy subsidies and linked domestic petrol and diesel prices to global markets, this will add some inflationary pressures in the country.”

Furthermore, the government has announced plans to implement more taxes on goods deemed harmful to human health or the environment in 2017 (including tobacco and sugary drinks) and on certain luxury items, it added.

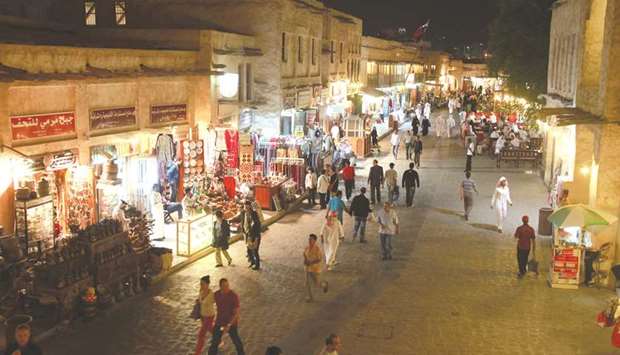

Although Qatar is also preparing to introduce a Gulf Cooperation Council (GCC)-wide value-added tax in 2018, BMI believes that the inflationary impact of this measure would be relatively limited, given its small size (5%) and the fact that many food items and essential services (including education) would be exempt.

Meanwhile, some of the upward pressure on inflation would be offset by increased housing supply, which has caused housing prices — a key driver of inflation in recent years — to fall in recent months, it said, forecasting Qatar’s inflation to average 2.8% in 2017 and 3.1% in 2018, from 2.7% in 2016.

On the interest rates, BMI said Qatar Central Bank (QCB) would continue to track the US Federal Reserve’s monetary tightening cycle closely through to 2019, given the riyal’s fixed exchange rate parity with the dollar. Highlighting that the QCB will continue to track the Fed’s tightening cycle through to 2019, given the riyal’s dollar peg, BMI said the central bank raised its overnight lending rate from 4 .75% to 5%, and its deposit rate from 1% to 1.25% on March 16 — shortly after the US Fed announced it would hike its benchmark interest rate by 25bps.

“We forecast one more 25 basis points (bps) hike to the QCB’s overnight lending rate to 5.25% in 2017 — and another two each in 2018 and 2019,” it said.

BMI expects the (interest rate) hikes to be carried out without much delay as rising global energy prices — with which domestic energy prices have now been aligned — and 2022 FIFA World Cup-linked projects boost Qatari economic activity and moderately increase inflation.

Qatar’s large foreign reserves — sufficient to cover 12.9 months of imports as of end 2016 — mean the central bank would be able to defend the riyal’s peg to the dollar should the interest differential with the US narrow.

Rising energy prices and FIFA World Cup-linked projects are set to push economic activity and inflation up, however, weakening the case for the QCB to delay hikes, it said, expecting Brent prices to average $57/bbl (per barrel) and $60/bbl in 2018, respectively — significantly higher than the $45.1/bbl level recorded over 2016.

Business / Eco./Bus. News

Qatar’s inflation ‘may rise’ to average 2.8% this year on subsidy cuts, new taxes

Visitors walk past stores in Souq Waqif in Doha. Although Qatar is preparing to introduce a GCC-wide value-added tax in 2018, BMI believes that the inflationary impact of this measure would be relatively limited, given its small size (5%) and the fact that many food items and essential services (including education) would be exempt.