After opening shops across New York, UK sandwich and coffee chain Pret A Manger may be heading for Wall Street.

Private equity firm Bridgepoint Advisers is considering a US initial public offering of the provider of tuna, mayo and cucumber baguettes and organic coffee, according to people familiar with the situation.

By looking at listing in New York rather than London, where Pret is based, the company is signalling its intention of making a bigger push into the rapidly expanding US market for healthier alternatives to burger chains and other fast-food outlets. Activity in the sector has been fuelled by deals such as JAB Holding Co’s plan to buy soup and sandwich chain Panera Bread Co.

Pret is “one of the standout brands in the lighter and healthier grab-and-go market and it certainly has phenomenal potential to go global,” Jeffrey Young, managing director at industry consultant Allegra Group, said by phone.

The US market for coffee-shop chains, including brands such as Tim Hortons and Dunkin Donuts, is set to reach $85bn by 2025 as customers increasingly eat out for breakfast, according to an October report from Allegra. At the end of 2016, Pret had 444 shops globally: 329 in the UK, 74 in the US, 19 in Hong Kong, 19 in France, two in China and one in Dubai.

By expanding in the US, Pret could accelerate its geographical diversification at a time when its UK operations face a possible squeeze from Brexit. The sandwich chain has said only about one in 50 job applicants in the UK are British and it’s taking steps to try to address a possible staff crunch if leaving the European Union results in immigration curbs, as the government of Prime Minister Theresa May has vowed.

An exodus of jobs from London’s financial district could also affect the chain’s core clientele of office workers. Whitbread, owner of the UK’s Costa chain, forecasts 91% growth in the number of coffee outlets in the country, to 27,412, from 2010 to 2020.

Pret said last month that it planned to reach 500 outlets globally within a year. It said US sales exceeded £200mn ($259mn), out of a total of £776.2mn for the chain in the year ended December 29.

Bridgepoint is working with advisers at JPMorgan Chase & Co, Jefferies Group, Credit Suisse Group, Barclays and Piper Jaffray Cos on the potential listing, the people said, asking not to be identified because the plans are private. The company has also been approached by bidders aiming to preempt the process, the people said. No final decisions have been made and Bridgepoint may still decide against a listing or sale, they said.

A representative for Bridgepoint said the firm is always exploring opportunities to ensure the future growth of Pret and will update the market if they materialise. JPMorgan, Barclays and Credit Suisse declined to comment. Representatives for Jefferies and Piper Jaffray didn’t immediately respond to requests. Bridgepoint bought Pret in 2008, eight years after the chain entered the US, acquiring it from founders Sinclair Beecham and Julian Metcalfe as well as McDonald’s Corp, which held a 33% stake at the time.

JAB, an investment vehicle of the billionaire Reimann family, has fuelled deal activity in the sector with a series of acquisitions, including coffee chain Keurig Green Mountain, doughnut baker Krispy Kreme Doughnuts and, most recently, Panera.

Companies in the US have raised about $20bn from IPOs this year, nearly 10 times more than those in the UK, as concerns about the impact of the UK’s decision to leave the EU and elections in key European economies hit investor appetite, according to data compiled by Bloomberg.

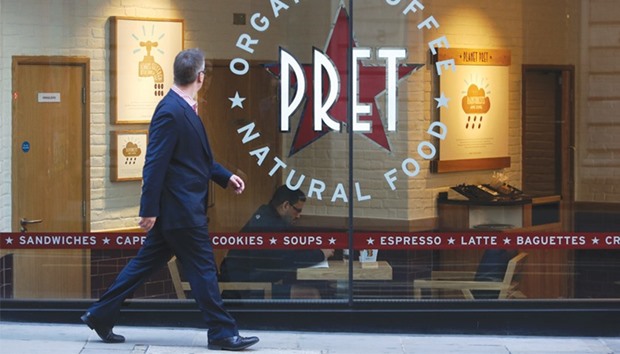

A pedestrian passes a Pret A Manger sandwich store, operated by private equity firm Bridgepoint, in London. By looking at listing in New York rather than London, where Pret is based, the company is signalling its intention of making a bigger push into the rapidly expanding US market for healthier alternatives to burger chains and other fast-food outlets.