London Stock Exchange Group probably won’t follow through on the sale of its French clearinghouse even though the buyer, Euronext, still wants to acquire it, according to people familiar with the discussions.

LSE agreed to sell the Paris-based clearing unit as part of an effort to convince European regulators to approve its merger with Deutsche Boerse.

But the German firm’s planned takeover has since all but collapsed, likely nixing plans for the €510mn ($553mn) sale of LCH.Clearnet, said the people, who asked not to be named because the conversations were private. An official regulator veto of the bigger deal is due as soon as this week.

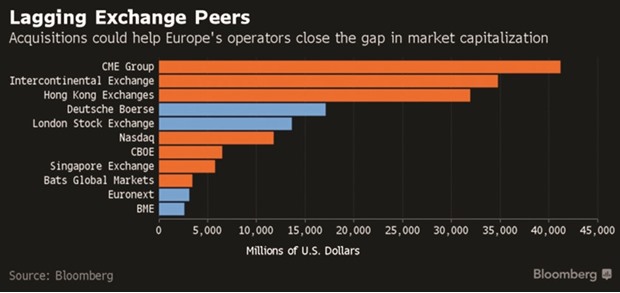

Euronext has been looking to transform itself with deals including Clearnet, though it would have faced a much bigger rival – Deutsche Boerse’s takeover of LSE would have created the region’s biggest exchange company had their deal succeeded.

“They need something big and bold,” Peter Lenardos, an analyst at RBC Capital Markets in London, said of Euronext. “They need to find a compelling clearing strategy.”

A spokesman for LSE declined to comment. A spokeswoman for Euronext confirmed Tuesday that the company is still a willing buyer of Clearnet.

Euronext runs markets in France, the Netherlands, Belgium and Portugal, but it lacks a derivatives clearinghouse, which holds collateral and monitors risks to prevent a default from spinning out of control. The exchange company accounts for about 50% of Clearnet’s revenue as its biggest customer.

Euronext’s hopes to buy Clearnet are “clearly diminishing,” but there’s a chance Clearnet’s management and minority shareholders could put pressure on LSE to complete the deal, Rosine Van Velzen, an analyst at ING Bank, said in a March 8 report. LSE is majority owner of LCH.

Even though Clearnet’s sale currently depends on the completion of the LSE and Deutsche Boerse deal, Euronext Chief Executive Officer Stephane Boujnah has said he wants to buy the unit regardless.

Boujnah has also said he’s prepared in any event to use the company’s wallet to reshape the firm – Euronext bought a stake in equity clearinghouse EuroCCP for €13.4mn late last year.

If Euronext moves its equity clearing to EuroCCP, Clearnet would miss out on revenue that accounted for about 33% of its 2016 sales, according to analysts at UBS Group.

.