Billionaire Mukesh Ambani’s plan to revamp his stake in Reliance Industries Ltd is aimed at reducing the potential tax bill for the founding family following changes in Indian levies, according to people with knowledge of the matter.

Ambani owns 46.5% of India’s second most-valuable company via at least 55 entities related to him or members of his family. The transaction is a hedge against future share sales, the people said, asking not to be identified discussing confidential matters. Fifteen firms affiliated to Ambani will transfer as many as 1.2bn Reliance shares to eight firms, any time after March 8, the company said in an exchange filing this week.

The move may help the family contain its liability from the sale at about $45mn compared with nearly $4.5bn if they were to do a similar deal after April 1 once the tax changes come into effect, according to data compiled by Bloomberg. India will levy a 20% tax on sale of certain shares held by individuals or limited liability partnerships from next month. A number of companies are weighing similar transactions to protect against future obligations, said Amit Maheshwari, a partner at accounting firm Ashok Maheshwary & Associates.

“Any prudent company would like to hedge its potential risks,” said Maheshwari. “This is merely a pre-emptive measure to avoid tax liabilities,” on any transaction from April 1, he said.

India currently levies no tax on gains from shares held for longer than a year by individuals or limited liability partnerships. Finance Minister Arun Jaitley in February announced a change to these rules beginning April 1. Entities, which didn’t pay the so-called securities transaction tax at the time of purchase, will be taxed as much as 20% on profits from the sale of these shares.

Both the buyers and sellers of Reliance’s shares, valued at about Rs1.5tn ($22bn) as of Friday’s closing price, will pay the securities transaction tax of 0.1% of the value of the deal.

A Reliance Industries spokesman did not respond to an e-mail and calls on his mobile seeking comment.

The entities participating in the planned Reliance transaction are part of the owner group, exempting it from rules under India’s takeover code that would trigger an open offer to minority stakeholders, according to the company’s filing. The purchase price will be the market price prevailing on the transaction date. However, it won’t exceed a 25% premium over Rs1,100.78 a share, the weighted average market price for Reliance shares over the past 60 trading days.

Most companies involved have held Reliance shares for at least six years and acquired them at a nominal price, without paying any securities transaction tax, the people said. A sale after March 31 would mean a significant capital gain that would fall under the new tax rule.

The selling firms will each retain at least 100 shares of Reliance, according to data compiled by Bloomberg. Entities related to the Ambani family have carried out similar share transfers at least twice before, without changing the owners total shareholding.

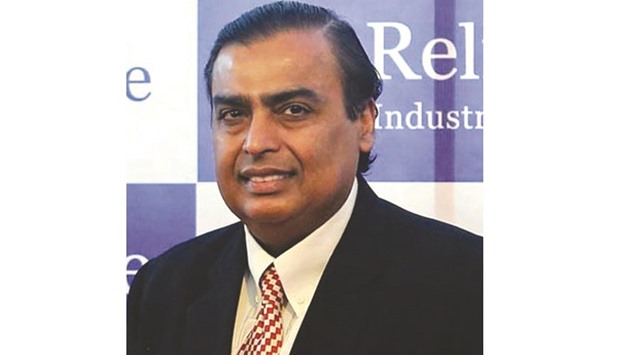

Ambani: Planning to revamp stake in Reliance Industries to reduce the potential tax bill for the founding family following changes in Indian levies.