A sudden, steep drop in Germany’s 2-year government bond yield to record lows yesterday was loosely linked to French election jitters but has left many investors puzzling over a move way out of kilter with other German and European bond market shifts.

Despite a plethora of fundamental and political influences, strategists suspect sharp declines in the two-year rate are being amplified by bottlenecks in the European Central Bank’s bond buying programme and some reckon an imminent change in European collateral rules surrounding securities repurchase agreements may also be to blame.

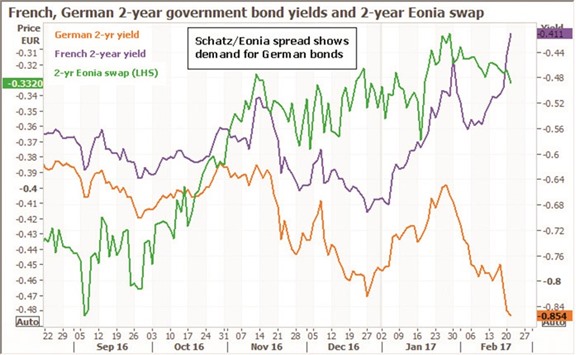

The two-year German Schatz yield hit a record low yesterday for a second successive day, falling to around minus 0.87%, and flying in the face of reports showing eurozone private sector and manufacturing business growth unexpectedly accelerating to near six-year highs in February. And while investor anxiety ahead of French presidential elections in April and May has seen some flight to German from French government debt in recent weeks, the two-year Schatz move ran counter to a rise in 10-year bund yields yesterday.

What’s more, the yield drop on Monday and Tuesday also came in the light of more positive news on Greece’s latest government bailout plan, with international lending monitors expected to return to Athens this month, and growing speculation about a rise in US interest rates since March.

“The short end of the German yield curve is now completely independent from all the macro moves, ECB policy and doesn’t really correlate with the long end of the curve either,” said Peter Schaffrik, head of European rates strategy at RBC Capital Markets.

“What I think is driving it is a shortage of the asset itself.” In essence, said analysts, there is a mismatch between supply and demand in short-dated German debt.

On the supply side, the German government plans to issue €1bn less in two-year debt this year than in 2016.

The high demand stems partly from the European Central Bank, which is buying German bonds for its asset stimulus programme, and from investors such as investment funds that need high-quality debt as collateral to raise money in markets and guarantee their trading positions.

Investors may also be buying up high-quality government bonds ahead of new European Union rules coming in next month that require banks and other investors to hold extra collateral against intra-day price swings on certain derivative contracts.

A squeeze on short-dated debt, pushing yields down, has been exacerbated in recent days by heightened investor nervousness about France’s unpredictable presidential race.

Germany is the eurozone’s benchmark issuer and its bonds are regarded as among the safest assets in the world.

While two-year German bond yields have fallen 10 basis points in just three trading sessions, German one-year treasury bills and five-year bond yields are down less than half that over the period.

German 10-year debt is down only 2 basis points in that time and were actually higher on the day yesterday.

“The strength in the German Schatz bond suggests this is a story about a scarcity of German debt and about supply and demand,” Commerzbank rates strategist Rainer Guntermann said.

And with the Schatz yield deeply in negative territory, investors are willing to pay — rather than be paid by the German government — to hold German paper.

The plunge in short-term German bond yields is also reflected in a rare divergence with Eonia money market rates.

The two have had a close relationship in the past, with both seen as signals on the outlook for economic growth and monetary policy. But with the German yields now driven by scarcity problems, money market rates may offer a better guide to where markets see ECB policy rates going, analysts said.

.