The European Central Bank (ECB) might consider scaling back its bond-buying programme early if the euro-area recovery picks up sufficient pace, according to a Governing Council member.

The issue is still “hypothetical” and any discussion is some way off, with a decision likely to be data-dependent, Bostjan Jazbec, governor of Slovenia’s central bank, said in an interview in Ljubljana on Tuesday. The ECB intends to cut quantitative easing to €60bn ($63bn) a month in April and keep it at that pace until the end of the year.

“There is a natural winding down which has to come, and another question is whether we would start this winding down early,” said Jazbec. “If the situation changes, we would of course change our approach. But it’s too soon to say.” The comments will feed into a debate over when to signal that the era of extraordinary stimulus is nearing an end for the euro area, which has posted 15 consecutive quarters of economic growth. ECB President Mario Draghi has labelled the topic of responding to better-than-forecast data a “high-class problem” that the Governing Council hasn’t discussed, while German politicians and media have led calls to taper QE and even raise interest rates.

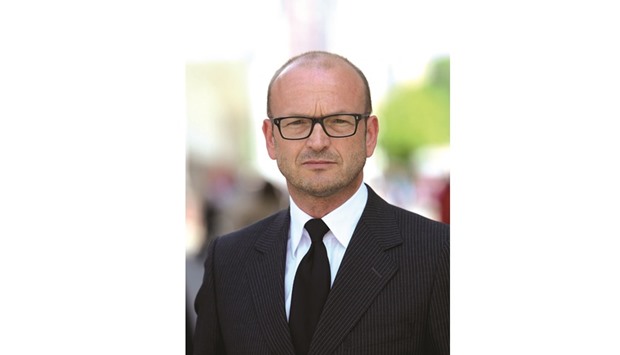

Jazbec, 46, speaking in his office surrounded by economics books and a stack of vinyls under a record player, largely agreed with Draghi’s sentiment.

“Whatever comes next will be a very, very well-thought response to what happens,” he said. “Personally I don’t feel comfortable saying anything about whether we are there yet.”

The pressure to at least discuss a QE exit has increased this year as euro-area inflation accelerates, with Executive Board member Sabine Lautenschlaeger calling for talks soon. Her colleague Benoit Coeure said the ECB will “monitor closely” price growth over the coming months before making further decisions on how to adjust stimulus, and Yves Mersch said implementing QE as promised is crucial to the institution’s credibility.

Jazbec said the ECB has already proved its determination in “standing behind the measures that we introduced.” Stimulus tools, although at times unpopular, were always “in line with our understanding of what was needed in the European economy.”

He has rather less praise for governments, saying that he’s “very unhappy that other policies are not taking advantage of the environment that the ECB created.” He called for a clean-up of the banking system, saying that non-performing loans cluttering up lenders’ balance sheets “severely impact” the pass-through of stimulus. He also argued that completing a banking union will complement the “strong” ECB and protect the region against external shocks.

Updated projections due in March may give officials a better idea about the degree of monetary accommodation the region needs. The ECB’s December forecasts, which see inflation accelerating from 1.3% this year to 1.7% in 2019, don’t fully take into account the impact of a surge in oil costs at the end of last year that has propelled consumer prices.

In the meantime, Jazbec said officials won’t hold back from sharing their views with each other over their decision-making, even if it’s outside the Governing Council’s formal policy-setting sessions.

“I can say consciously that we discuss about this all the time,” he said. “Because if we did not discuss, then we would only be having nice dinners at the ECB every other Wednesday, and that would be it.”

Jazbec: Cautious on monetary policy.