There was a time when the global aluminium market could be seen as two parallel universes, to borrow a phrase coined by Klaus Kleinfeld, chairman and chief executive of Alcoa. There was China. And there was the rest of the world.

The great dividing wall was China’s 15% export tax, effectively preventing the flow of primary metal out of what was already the world’s biggest volume producer.

There was always an element of wishful thinking in Kleinfeld’s parallel vision, ignoring as it did the flow of semi-manufactured aluminium products out of China.

But in terms of physical and paper trading of commodity-grade aluminium, the analogy just about held, until only a few years ago. Alcoa has since divided itself into two separately listed companies but the two parts of the global aluminium market have moved ever closer.

The physical export flow of “semis” has steadily increased with over four mn tonnes leaving China in both 2015 and 2016. And, equally significantly, the two main trading venues of London and Shanghai have started to connect, with the eastern universe exerting increasing influence over the western.

Arbitrage between the London Metal Exchange (LME) and the Shanghai Futures Exchange (ShFE) has been long established in markets such as copper. But in aluminium it’s a newer phenomenon dating to the end of 2015.

That’s when the Shanghai aluminium contract experienced a step-change in usage with market open interest and volumes exploding. At the time it looked like one of those crowd trades that have roiled other Chinese commodity exchanges at various times over the last couple of years.

Producers lashed out at “irrational” speculation as prices collapsed under a torrent of short-selling.

And maybe it was. But Shanghai’s new aluminium friends have stayed with it ever since.

Volumes almost doubled last year and market open interest remains a multiple of what it was prior to the fourth quarter of 2015.

That in turn has generated greater connectivity with the London market.

The clearest manifestation is the higher trading volumes during the overlap between the Shanghai and London trading days, according to the LME’s “Insight” team of analysts.

So-called LME “Asian hours” trading jumped from 5% of the daily total in the third quarter of 2015 to 9% in the fourth quarter of that year. That ratio held pretty steady last year, averaging 8%.

Moreover, “the LME-ShFE arbitrage has swung more aggressively since Q4 2015 and LME prices have been more volatile in Asian hours,” particularly during times of high Shanghai turnover, according to the LME.(“LME Aluminium: West to East as Asian influence rises”)

The precise origin of this liquidity boost is unclear. It may well be that the increased flow of semi-manufactured products out of China has generated increased arbitrage between the two markets.

But as the LME’s Insight analysts concede, “a genuine increase in intraday activity suggests the relationship has widened beyond just merchants hedging physical profits.”

“On-screen traders are increasingly trading the aluminium arb or, at least, allowing the direction of one market to influence trading on the other.” Liquidity, in other words, begets more liquidity.

This is true of all exchanges but maybe particularly true of China where speculators hunt in packs.

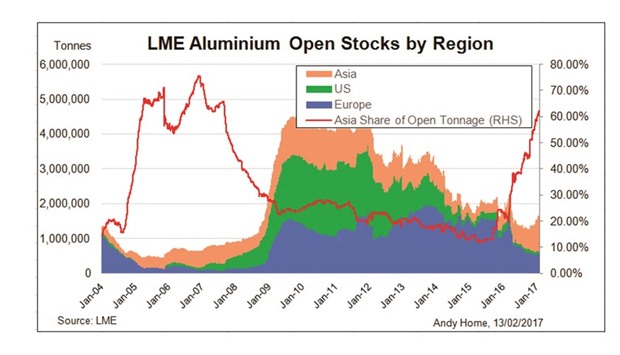

Working in parallel, as it were, with this increased trading connectivity has been a steady shift in the location of LME stocks away from the United States and Europe towards Asia.

As of the end of January over 60% of “live” LME stocks, meaning those not in the form of cancelled warrants, were located at Asian locations. It’s the highest ratio since 2007, although the historical comparison is muddied by the fact that LME stocks were much lower prior to the 2008-2009 global financial crisis.

This in part may also reflect that steady stream of semi-manufactured product leaving China.

If it is displacing primary metal in the rest of the world, it is logical that the hardest impact would be in the closest geographical region.

But in part it’s also down to the LME’s own policy of targeting excessive load-out queues at some of its locations in Europe (Vlissingen) and the United States (Detroit).

Recent tightness in the LME contract’s time-spreads have incentivised physical deliveries into the exchange’s warehousing network. With some queue-affected operators elsewhere reluctant to take in more metal, the default delivery location has shifted from west to east.

Andy Home is a columnist for Reuters. The views expressed are those of the author.

ALUMINIUM