The dollar recovered against its major peers yesterday after taking a battering the previous day, while the pound fell back having surged on the UK’s Brexit plans.

The London stock market, which has been moving in opposite directions from the pound, recouped some of the previous day’s losses seen after Prime Minister Theresa May said she was readying Britain to leave the EU’s single market.

“The British pound, drifting lower in a correction of its biggest daily gain since 2008, helped the UK equity benchmark to modest gains,” said Jasper Lawler, senior market analyst at London Capital Group.

“We view the move in the British pound following the Prime Minister’s speech as a game-changer and as such don’t anticipate a near-term resumption of the record winning streak for the FTSE 100,” he said.

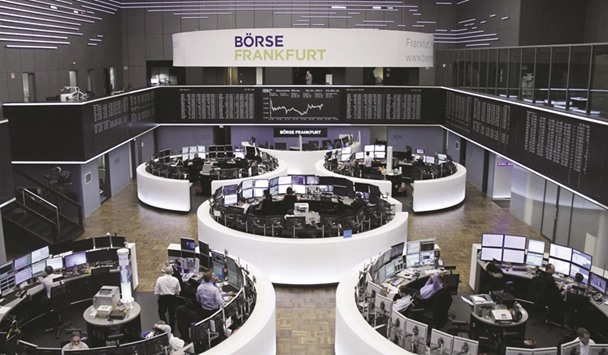

Among eurozone stock markets, Frankfurt gained 0.5% at 11,599.39 while Paris posted a slight loss at the close.

Wall Street was hovering near Thursday’s closing level approaching midday in New York.

Shares in UK publisher Pearson plunged after it issued a profit warning and said it would sell holdings in Penguin Random House, a joint venture with German media company Bertelsmann.

The greenback’s recovery came after a sharp fall Tuesday following comments from the US president-elect in an interview that it was too strong and that a weak Chinese yuan was “killing us”, fuelling concerns of a possible currency war.

The sell-off marked a sharp turnaround for the US unit, which has been surging since Trump’s November election on expectations his big-spending, tax-cutting plans will fan inflation and force a Federal Reserve rate hike.

Trump’s comments came days before he takes the oath of office on Friday, with market-watchers hoping his speech will provide some detail on his plans for the US economy as well as his intentions on the global trade front.

While up on the yen, euro and pound, the dollar struggled against higher-yielding units including South Korea’s won, the Australian dollar and Malaysian ringgit.

The pound fell on profit-taking after surging Tuesday when May set out her plan to leave the customs union and single market in a so-called “hard Brexit” and promised to let parliament vote on the deal.

Sterling shot up three% – its biggest gain since 2008 – to more than $1.24 following her remarks, having plunged below $1.20 Monday as news emerged of her plans.

Oil slipped after Opec reported that its output inched lower in December but not by as much as the cartel promised in a landmark production cut deal reached the previous month.

Traders at the Frankfurt Stock Exchange. The DAX 30 gained 0.5% at 11,599.39 yesterday.