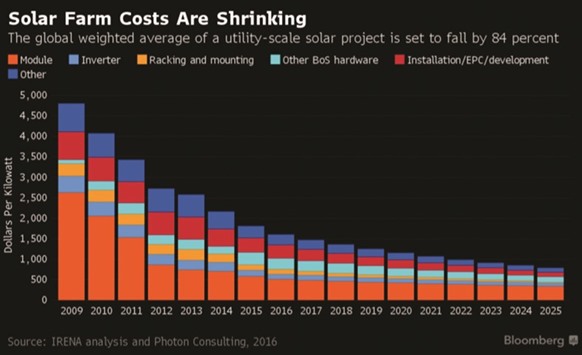

The idea that solar power may soon be everywhere isn’t nutty anymore. The price of solar panels has plunged more than 80% in the past five years and is expected to keep falling. Global output from photovoltaics, panels that convert light directly into electricity, has increased 40% every year for the past decade. The industry is drawing roughly $150bn in annual investment, accounting for almost half the funds committed to renewable energy. In some places where the price of power is high, solar already is able to compete with fossil fuels on cost. But the idea, pushed by some environmental groups, that solar could soon meet the world’s energy needs seems far less likely. For one thing, those big increases come on top of a tiny base — in 2013, solar accounted for less than 2% of the world’s electricity supply. For another, there are still nights and cloudy days to deal with. Since we like our power always available, that means that cost versus coal isn’t the only hurdle — there’s figuring out how to feed a lot of intermittent power into a system meant for steady production.

That could make the outlook for solar partly cloudy.

The Situation

Energy generated by solar grew by a third in 2015, more than for any other power source. The global agreement reached in Paris in December on fighting climate change didn’t include specific provisions on solar, but the pact was considered certain to spur significant new investments in renewable energy. In the US, Congress reached a budget deal that extended tax credits for wind and solar power for five years. The solar credit had been set to expire at the end of 2016. Bloomberg New Energy Finance estimated that the extension will generate $38bn in new solar power investment. In addition, federal rules announced in August 2015 requiring states to reduce carbon emissions could encourage investments in renewables if they survive a court challenge. Already, 43 of the 50 states have adopted renewable power goals; California’s target is 50% of power by 2020, up from about 20% now. Elsewhere, a number of nations, led by Germany and Spain and most recently the UK, have scaled back lucrative solar incentives as prices have fallen.

Worldwide, installations are highest in China, followed by Japan. In India, plans have been announced for $160bn in solar power projects. Some big businesses have made splashy announcements, including Apple’s plan to spend $850mn on solar power.

The Background

The US invented solar cells but never had the determination to commercialize them. AT&T’s Bell Labs in New Jersey made the first photovoltaic cell in 1953. For decades, solar only made economic sense in satellites. Oil companies led by Exxon and Arco invested in solar panels — arrays of photovoltaic cells — following the oil crisis in 1973, then backed out when the price of crude crashed in the 1980s. Japan kept the industry alive through the 1990s, when Sharp, Kyocera and Sanyo were producing the majority of the world’s cells. In 2004, Germany introduced an expanded system of feed-in tariffs, fixed-price contracts for renewable power that is supplied to the energy grid. Solar installations soared, and for several years Germany led the world in solar panel manufacturing. The tariff model was copied in other countries and so many new solar panel makers sprouted up that a price war followed. That led to the crash in the price of panels – and the concentration of the industry in China, where companies led by Suntech Power built giant panel factories with loans from the government and cash from foreign investors — support that allowed them to survive a winnowing that shut many manufacturers elsewhere.

The Argument

Greenpeace says solar “could meet the world’s energy demands many times over.” The more cautious International Energy Agency says photovoltaics might generate 16% of the world’s electricity by 2050 — if policy encourages the technology. Fossil fuel backers say photovoltaic power will never be a practical source because it can’t work when the sun doesn’t shine and because it’s too expensive. Solar power’s cost is now almost double the cost of the same energy from coal. But a longer view may be more favourable to solar, whose cost is falling as the price of coal goes up.

Utility officials and regulators make decisions on the basis of decades-long projections, and price is only part of the equation. There are technical considerations, like whether the grid can absorb variable flows of electricity from renewables. The biggest question is ultimately political: What countries are willing to pay now for an energy source that may be cheaper and will undoubtedly be cleaner in the long run. The logic of the Paris agreement suggests the amount could be substantial. And if there’s a breakthrough in solar’s biggest weakness — an affordable way to store electricity for use at night — all those calculations could be upended.