Energy companies in the Middle East reduced their borrowing by 26% in 2016 as an increase in oil prices late in the year provided revenue needed for exploration and production.

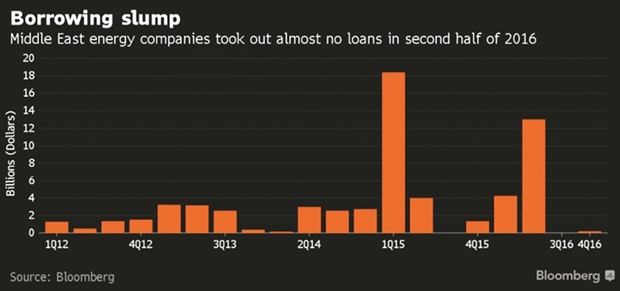

Bonds and loans issued by energy producers in the six- nation Gulf Cooperation Council declined 26% to $17.5bn from a record $23.7bn in 2015, data compiled by Bloomberg show. Oil trader BB Energy Gulf DMCC in Dubai was the only borrower in the final six months last year, taking out $200mn to refinance debt.

Crude oil rallied 16% in the final three months of 2016 as oil producers from Opec and 11 non-Opec nations agreed to cut output this year. Before the rally, lending had surged as energy companies turned to banks and investors for cash as borrowing costs fell and oil prices declined. The drop in lending later in the year was a boon to those who did borrow, with BB Energy increasing its refinancing from $175mn as the deal was oversubscribed.

“If oil prices go up a few notches, it will help them rely less on international borrowing,” John Sfakianakis, director of economics research at Jeddah-based Gulf Research Center, said by phone from Athens. “There’s more money available for oil companies to keep within rather than go out and borrow.” Borrowers also held back as costs increased. The JP Morgan Middle East Composite Index of the region’s debt yield, an indication of borrowing rates, averaged 4.7% last year compared with 4.43% in 2015. The gauge had dropped to a 16-month low in late August. In December, the US Federal Reserve raised interest rates and forecast a steeper path for 2017 increases.

In contrast to industry, governments in the Gulf region increased borrowing following a halving of oil prices since 2014, forcing some of them to use foreign cash reserves. Saudi Arabia led sovereign issues, raising $17.5bn in the biggest emerging-market bond sale in October.

.