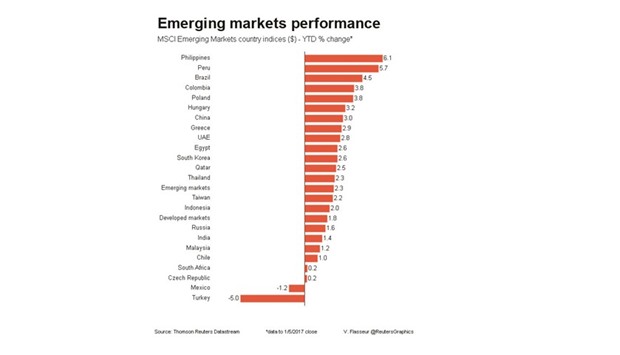

Emerging stocks were set to end the first trading week of 2017 with gains of over 2%, benefiting from buoyant global equity sentiment, a dollar retreat and Chinese action to quash yuan market speculators.

The offshore-traded yuan was set for its biggest weekly gain ever, hovering around two-month highs after authorities were suspected of pushing up overnight borrowing costs to discourage bearish bets on the currency.

The onshore yuan’s official mid-point meanwhile was set 0.9% firmer than the previous fixing for its biggest upward move since 2005.

“The developments we have seen in the offshore money market are a sign of the authorities trying to make it more expensive to short the offshore yuan.

It seems like they are squeezing out the shorts and they are succeeding with that,” said Jakob Christensen, head of EM research at Danske Bank.

But he saw the Chinese relief as short-term, predicting the dollar/yuan rate at 7.3 in a year’s time as economic growth slows and capital outflows continue.

The Chinese moves lifted Asian currencies, though moves elsewhere were dampened by dollar gains ahead of key US jobs data.

Emerging equities pulled back half a per cent from two-month highs, despite weekly gains.

The other big emerging market pressure point is Turkey where the lira fell another 0.7% to stay near record lows versus the dollar.

The country is facing sluggish growth, high inflation and an escalation in militant attacks but the central bank remains reluctant to raise interest rates.

The lira has lost more than 2% this week after falling 17% against the dollar in 2016.

Christensen said the politics and central bank weakness made it a “perfect storm” for Turkey.

“Bond investors are quite concerned about their holdings in Turkey. People are questioning whether the central bank will have the independence to fight the rise in inflation,” he said.

The South African rand also slipped 0.6% off four-week highs against the dollar.

However, the Mexican peso rose 0.4% after the central bank reportedly sold around $1bn on Thursday to stabilise the currency, which had plunged to fresh record lows following more critical comments from US President-elect Donald Trump.

Mexican five-year credit default swaps held steady at 163 basis points, a one-month high, according to Markit data.

There was a boost for Argentina, with JPMorgan saying its bonds would be included in the GBI-EM index suite for emerging currency debt.

Emerging debt funds received $1.9bn for their first inflows in nine weeks, although equity funds lost money for the third straight week, according to Bank of America Merrill Lynch.

EMERGING