During last year, the International Accounting Standards Board (IASB) announced the new IFRS 16 Leases accounting standard which shall replace the current IAS 17 lease accounting guidance. The new IFRS 16 requirements eliminate nearly all ‘off balance sheet’ accounting for lessees and this will be one of the biggest developments to accounting standards in the last decade. Businesses in the Middle East region now need to prepare themselves for its impending impact.

How will companies be impacted by the new IFRS 16 leases standard?

For lessees, the new IFRS 16 standard will impact across a number of key areas:

n Future operating lease liabilities will now be brought ‘on balance sheet’ increasing leverage. These new liabilities will be primarily offset by a new ‘right to use’ asset and the overall effect will be to gross up the balance sheet;

n Rent expense will be replaced by depreciation and interest expense in the income statement. This is likely to result in both a front-loading of expenses and a change in the geography of income statement expenses with EBITDA increasing;

n The above impacts will also flow through to key measures and ratios. In some circumstances key metrics monitored by lenders through covenant testing could be impacted or even breached as a result of IFRS 16;

The implications of this new standard reach far beyond the financial statements of a company, however. Entities will also need to ensure they have systems and processes that can identify all lease contracts and all relevant information for the new IFRS 16 basis of accounting — in this regard the requirements of IFRS 16 will be more onerous.

When should companies start thinking about this new standard?

Companies will not be required to adopt IFRS 16 until 2019 but many companies are already rightly trying to prepare for this new standard for the following reasons:

n Stakeholder message management — understanding and communicating to relevant stakeholders (for example senior management, shareholders and lenders) the impact of the new standard on the financial statements will be important to ensure key messages can be appropriately managed;

n Preparing systems and processes — for groups with large volumes of leases there may be significant systems and processes implications to be ready for the requirements of IFRS 16;

n Entering into new contracts — by understanding the implications of IFRS 16 now it will be possible to avoid unknowingly entering into a contract now that would have an adverse accounting consequence. Whilst accounting should not necessarily drive commercial discussions, it may be possible to structure new agreements in a way that partially mitigate the impact of IFRS 16.

Who will be impacted?

The impact of IFRS 16 will be primarily felt by lessees who currently have large value and or volume of operating leases.

Although virtually every industry uses leasing as a means to obtain access to assets. The type and volume of assets that they lease, and the terms and structures of these lease agreements differ significantly. For example, a professional services firm leases cars and corporate offices; a utilities company leases power plants; a retailer leases retail stores; a telecoms entity leases fibre optic cables and cell towers; and an airline leases aircraft — all with very different characteristics, terms, regulatory frameworks, pricing, risks and economics. As a result, different implications may arise for different industries when adopting the new leases standard.

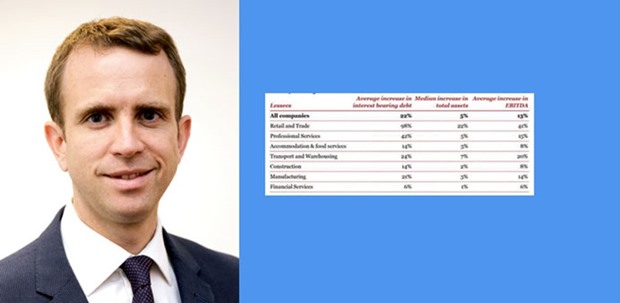

PwC has conducted a global lease capitalisation study* to assess the impact of the new leases standard on reported debt, leverage, solvency, and EBITDA for a sample of more than 3,000 listed entities reporting under IFRS across a range of industries and countries. The research identifies certain industries that will be specifically impacted by the new standard across both key leverage and EBITDA measures.

The above reflects the fact that those industries with heavy operating lease usage shall be most impacted — with the stand out sector being retail where median debt shall increase by 98% and EBITDA by 41%.

It should also be noted that lessor accounting will be relatively unchanged under IFRS 16. This does not mean, however, that this new standard is not relevant for lessors and they will need to consider how this standard will impact their customers and potentially their commercial negotiations with lessees.

What should companies be doing now?

We anticipate that internal and external stakeholders will want to understand the impact of the new leases standard well before the effective date of 2019. This should encompass a number of areas, including:

n Understanding the financial impact of IFRS 16 on the company’s financial statements and key metrics;

n Timely assessment of which arrangements and stakeholders are affected by these redefined financial ratios and metrics enables an entity to proactively revise its arrangements if needed and engage its stakeholders;

n Entities should check whether IFRS 16 will impact their existing and future financing arrangements to avoid surprises and difficult negotiations with lenders.

n Assess whether current systems and processes are ‘fit for purpose’ for IFRS 16;

n Commence cataloguing existing leases and identifying lease data gaps. Where a company has a large volume of leases this can be one of the most time consuming exercises in preparation for IFRS 16.

In summary, for many industries and companies IFRS 16 will be a game changer. Where company’s has a large variety and volume of leases we expect the adoption of this new standard will be complex and take time — company’s should therefore be planning and preparing accordingly.

* PwC and Rotterdam School of Management in the Netherlands, “A study on the impact of lease capitalisation — IFRS 16 the new leases standard”, February 2016.

*Blaise Jenner is PwC Middle East Partner in Capital Markets and Advisory Services.

Blaise Jenner