Chinese factory activity data boosted broader emerging equities to near three-week highs yesterday.

The lira traded almost at 3.6 per dollar, down 1.4%, after sharp rises in food and drink prices pushed Turkish inflation to 1.64% in December for an annualised 8.53%.

That further soured sentiment towards Turkish assets, already battered by a series of militant attacks in recent months, including a New Year’s Day mass shooting.

Worries about a slowdown in the economy and plans for an executive presidency have also undermined confidence.

The security situation also makes it unlikely that tourism, a key part of the economy, will recover in 2017.

“The inflation number is worse than expected...it’s an awful number and obviously there is a lag of months before the full effect of lira depreciation...is reflected, so one would expect core inflation to remain high from here,” said Paul Fage, an emerging market strategist at TD Securities.

Ten-year government bond yields rose to three-week highs, Turkish five-year credit default swaps rose three basis points (bps) from Monday’s close to 273 bps, according to Markit data and Turkish stocks fell 0.3%.

Fage noted that a presidential adviser had said a rate hike would “break the economy’s back”, implying intense pressure on the central bank to avoid much-needed rate hikes.

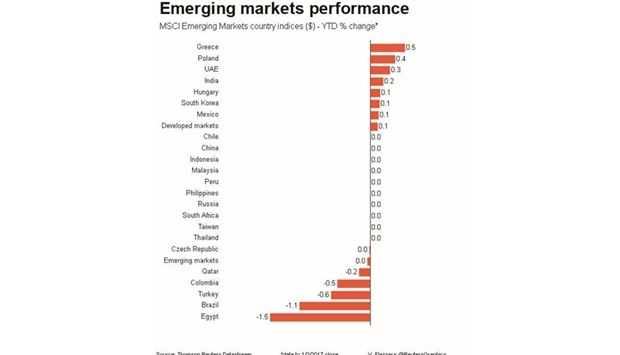

“It’s unlikely they will do the big emergency hikes they did in the past and if they do hike it will be the order of 25-50 bps,” he added. Other emerging markets were broadly supported by robust manufacturing data and a rally in oil prices, with the benchmark emerging stocks index up 0.2%, though the dollar’s 1% rise capped gains.

The focus was on the Chinese yuan which slipped 0.2%, despite state bank support after weakening 6.63% in 2016, its biggest annual fall since 1994.

Chinese citizens have started to make use of their annual $50,000 foreign exchange conversion quota.

But the regulator said on Saturday that it would increase scrutiny on currency purchases and strengthen punishment for illegal outflows.

Commerzbank highlighted the overnight Hong Kong interbank rate’s surge to 18.5%, “a signal that China’s currency is under great pressure again”. Liquidity tightening is a typical phenomenon when the currency is facing huge sell-off pressure, the bank’s analysts said.

However, China’s factory output rose to a near six-year high in December, Purchasing Managers (PMI) data showed.

This helped lift China’s mainland shares around 1% and Hong Kong stocks almost 0.7%, to three-week highs.

Korean stocks also rose 0.9%, closing at a 10-week high after index heavyweight Samsung Electronics hit a record high.

Moscow shares hit a new record high, up 2%, supported by a 2.3% rally in Brent crude oil futures to around $58 a barrel.

The rouble also gained 0.6% against the dollar in thin holiday trade.

In central Europe, Polish stocks gained around 1% to hit their highest since April 2016 after PMIs showed manufacturing expanding at the fastest pace in 17 months.

.