Qatar’s 2017 budget intends to reduce the government’s deficit while supporting growth through higher capital spending with public investment to be the main fulcrum for future economic growth, according to QNB.

“Qatar’s budget outlines a clear intent to reduce the government deficit while also supporting growth through higher capital spending,” the country’s largest public sector bank said in a report.

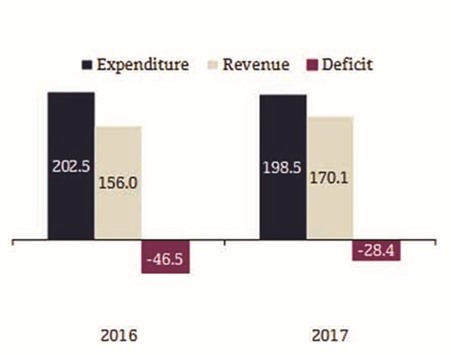

Highlighting that the budget is committed to reducing Qatar’s planned deficit by 38.9% from QR46.5bn in 2016 to QR28.4bn in 2017, it said the deficit is expected to decline due to a pickup in government revenues and continued rationalisation of current expenditure.

The revenues are expected to increase 9% year-on-year in 2017, based on an oil price assumption of $45 per barrel. On the expenditure side, the budget predicts a slight decline of 2% but the composition of spending is expected to change, the report said.

Current expenditure - which includes salaries and wages - will decline 6.6% in 2017 as the sovereign continues to enhance the efficiency of public spending and benefits from cost savings from the consolidation of ministries in previous years. Current expenditure’s share is expected to fall from 53.3% of total spending in 2016 to 50.8% in 2017. In contrast, capital spending is planned to increase 3.2% with its share of total spending rising from 46.7% in 2016 to 49.1% in 2017.

Capital project spending will be targeted at transportation and infrastructure (21.2% of total spending), health (12.3%) and education (10.4%).

“The commitment to ramp up future capital spending indicates that public investment will continue to be main driver of economic growth in the coming years,” QNB said, adding the investment programme will also support the drivers of Qatar’s long-term growth, evidenced by the sizeable investments in the education and health sectors.

Finding that capital spending is expected to increase this year to support Qatar’s preparation for the World Cup and economic diversification objectives, it said the government has also outlined in the budget an intent to further accelerate investment and infrastructure spending in the coming years.

The Ministry of Finance has also signalled an intention to boost future capital spending, announcing that the government will agree to QR46.1bn worth new contracts in 2017, adding to a stock of QR374bn non-hydrocarbon sector projects already initiated by the public sector.

The government also announced it will continue to finance the deficit through domestic and external debt instruments and not draw down on accumulated reserves, QNB said.

In 2016, Qatar secured a $5.5bn syndicated loan and successfully issued $9bn of bonds. Its reserve position remains strong, with accumulated current account surpluses of $323bn at the end of 2015, which accounted for 193.6% of gross domestic product, it said.

.