Global equity gains and stronger commodity prices lifted emerging stocks 0.7% yesterday, though worries about China weighed, with offshore yuan overnight rates hitting three-month highs.

Data showing steadily rising US house prices and consumer confidence at its highest in more than 15 years underscored the strength of the economic recovery, boosting equity markets and allowing MSCI’s emerging stocks to rise to six-day highs.

However, emerging markets face headwinds from a stronger dollar and US yields at one-week highs.

Asian currencies touched multi-month lows, also feeling the heat from the yuan which has lost 6.6% against the dollar this year and is trading near 8-1/2 year highs.

Traders expect depreciation pressures on the Chinese currency to extend into January when individuals get a fresh $50,000 foreign-exchange conversion quota.

Authorities’ efforts to check outflows via tighter liquidity saw Hong Kong’s overnight yuan borrowing rate jump to its highest level in more than three months.

“All eyes are on yuan weakness, although all currencies are wilting against the vicious dollar rally at the moment,” TD Securities said in a note.

Jitters about emerging markets fuelled outflows of $3.35bn from dedicated EM equity funds, excluding China A-share funds, in the week ended December 21, the second largest outflow week in 2016.

But global equity gains and signs of perkier growth have lifted commodities, with copper, widely used in power and construction, up around 20% this year on the Shanghai exchange and on track for its largest annual rise since 2010.

Iron ore on the Dalian exchange is up 170%.

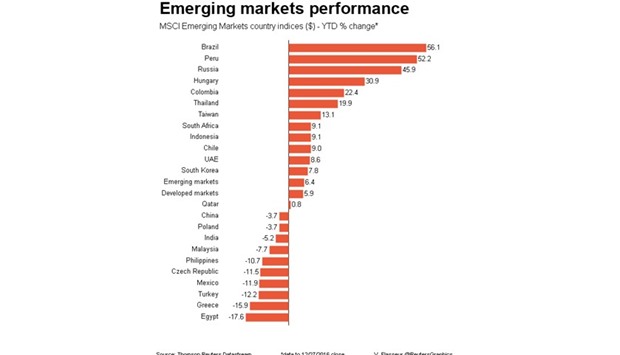

That is likely to benefit commodity producing emerging markets such as Russia, Brazil and South Africa in 2017.

“Our portfolios retain a strong commodities/oil bias throughout, to benefit from the current price stabilisation, improved outlook and the prospect of a Trump-induced infrastructure boost next year,” JPMorgan Asset Management’s head of emerging debt, Pierre-Yves Bareau, told clients.

In eastern Europe the Romanian leu slipped 0.22% to approach six-month lows against the euro after President Klaus Iohannis rejected the Social Democrat Party’s nominee for prime minister.

Two weeks after an election, Romania remains without a government and is facing the risk of a serious political crisis.

The Ukrainian hyvnia fell sharply for a second day, staying close to 3-1/2-month lows to the dollar.

The central bank attributed the volatility to end-month debt repayments and said it would sell $100mn to support the currency.

.