Qatar’s current account may turn surplus next year as oil prices improve and the strong dollar reduces the cost of imports, Samba Financial Group has said in a recent report.

However, Samba foresees a small current account deficit for Qatar this year.

Qatar’s current account moved into a first-half deficit of $4.8bn, thanks to a 33.4% fall in export revenues and a 17.9% increase in import receipts compared with the first half of 2015.

The country actually maintained a trade surplus of $3.4bn, but large remittances contributed to current transfer outflows of $8.2bn, which tipped the current account into deficit.

Qatar’s capital and financial account produced a $5.3bn surplus in the first half of the year, thanks largely to second-quarter portfolio inflows of $11.4bn.

Net errors and omissions of negative $1.4bn meant that the balance of payments recorded a first half deficit and subsequent decrease in foreign exchange reserves of $1bn leaving them at $34.6bn at end-June, Samba said.

Although more recent balance of payments data is not available, since then forex reserves have ticked up slightly and stood at $35.2bn at end-August.

Qatar still maintains the same ratings (AA S&P/ Fitch and Aa2 Moody’s) as it did in June 2014 when oil prices were in excess of $100 a barrel.

Moody’s has placed the sovereign on negative watch whereas S&P have reaffirmed the stable outlook. Despite the prospect of twin external and fiscal deficits this year, the country’s large external reserves held at the Qatar Investment Authority (nearly $335bn), small population of nationals, large hydrocarbon reserves and efforts toward fiscal consolidation have assuaged investors and credit rating agencies alike. Five-year CDS spreads have levelled off at 90bps from a high of 146 in 2015.

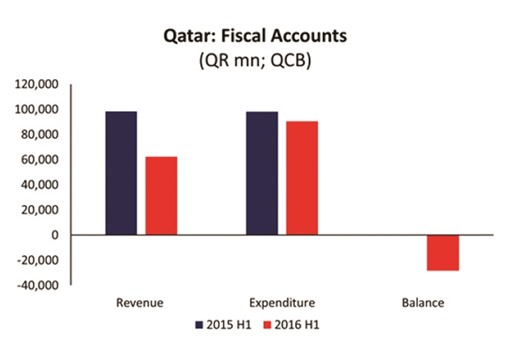

Citing Qatar Central Bank data, Samba said the deficit for the first half of 2016 came in at $7.8bn, or 10.5% of GDP. From the same period last year, revenue has fallen by 36.7% while expenditure has declined by 7.7%.

Samba foresees a full-year deficit of $12bn (7% of GDP) as the fiscal consolidation efforts made in early 2016 begin to pay dividends.

These fiscal consolidation efforts include subsidy cuts on fuel and utilities, substantial redundancies in government and public sector companies, merging and cutting of government ministries, and scaling back and making efficiencies in projects driven by public spending.

Despite these prudent steps, and the prospect of small fiscal deficits through to 2018, spending will be maintained at a healthy level in order to complete the activities associated with the 2022 FIFA World Cup.

The authorities have stated that any fiscal deficits will be financed entirely through debt issuance rather than drawing down the country’s large assets held at the QIA.

Issuance has stepped up apace over the last 14 months, in which time the government has tapped both domestic and international markets to raise $30.8bn.

award