The dollar charged to a 14-year high and government bond yields rose sharply yesterday after the Federal Reserve hiked US interest rates and signalled more would follow at a faster pace next year.

European shares cheered a 2.5% rise in bank stocks on the prospect of a boost to their profits and the Dow Jones index looked set for another run at 20,000 points.

But the main action was elsewhere.

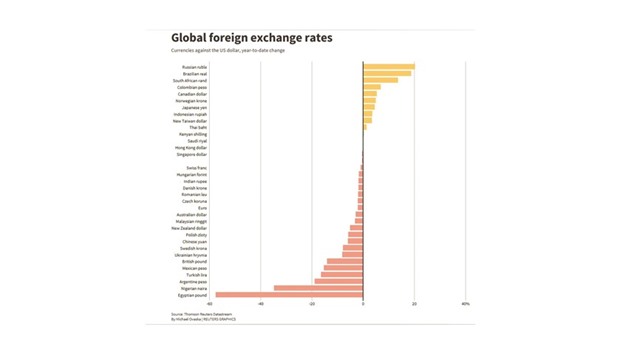

Bond markets saw yields on short-term US debt surge to the highest since 2009, sending the dollar galloping past key euro levels, to a 10-month peak on the yen and prompting China to set the yuan at its weakest in eight years.

The Fed’s anticipated policy path, and expectations that Donald Trump as US president will get growth motoring, are keeping emerging markets on edge as capital gets sucked from more fragile, export-dependent economies toward dollar-based assets.

The Fed’s rate rise of 25 basis points to 0.5-0.75% was well flagged but investors were spooked when the “dot plots” of members’ projections showed a median of three hikes next year, up from two previously.

“You had the Fed come in and be a bit more hawkish than many people, including us, were expecting,” said TD Securities head of global strategy Richard Kelly.

“It wasn’t just the move in the dots, it was the language that was used.

There was an acknowledgement that if Trump gets his plans moving through Congress you could see the economy pushing higher.”

The Fed’s economic projections have hardly been upgraded, suggesting it could accelerate the monetary tightening even further if policymakers see firmer evidence of higher growth or inflation.

Fed fund futures slid to imply an almost 50% chance that the Fed would raise rates three times, with two hikes fully priced in already.

The dollar continued to rise in European trading.

It hit a 10-month high of 117.87 and then jumped through $1.0425 per euro, while the difference in yields on benchmark 10-year US and German government bonds ballooned to the widest since at least 1990.

Those US yields rose as far as 2.63%, having already risen more than 0.8 of a percentage point since Trump was elected last month.

The jump in 2-year Treasury paper was the biggest daily rise since early 2015 as it topped 1.29%.

“One of the reasons why a bond market sell-off this time around looks more sustainable is because it can be accompanied by higher equity markets,” Peter Schaffrik, chief European macro strategist at RBC Capital Markets said.

The allure of higher US yields raises risks for emerging markets, as funds look to take advantage of rising US rates rather than put their money in traditionally riskier economies.

China’s central bank reacted to the Fed’s move by setting the yuan mid-point at 6.9289 to the dollar, its weakest since June 2008, though market players noted that the yuan has been firmer against many other currencies and rose on trade-weighted basis.

Currencies such as the Singapore dollar and Korean won came under pressure, and analysts anticipate most low-yielders will be on the back foot in an environment of a rising dollar, higher yields and weaker yuan.

Mexico, whose markets have been battered hardest by Trump’s threats to tear up trade deals, holds a central bank meeting later where it is expected to hike its own interest rates in response to the Fed and try to prevent further damage. The Bank of Korea gave a taste of the challenges many EM economies face.

It held its key rate at a record low of 1.25% despite flagging the growing risks on its export-reliant economy.

Globally emerging market stocks fell 1.6%, though developed economies and the major currencies were at the dollar’s mercy too.

The euro dropped to as low as $1.0425 despite some upbeat economic data.

The break below its March 2015 low of $1.0457 was a significant milestone, opening the way for a test of $1, or parity against the dollar, which last happened in late 2002.

That drew reaction from Switzerland, which is highly sensitive to the euro’s moves.

Its central bank head said another cut in Swiss interest rates couldn’t be ruled out, though the Swiss franc took little notice.

Wall Street was expected to open higher when it resumes, having suffered on Wednesday its biggest percentage decline since before the November 8 US presidential election.

That decline was modest, however, compared with the strong gains of the last month that have set a string of record highs and put the Dow Industrial index within touching distance of 20,000 points.

Among commodities, oil prices stabilised as a tighter market looms in 2017 due to planned output cuts led by Opec and Russia.

Earlier they had seen sharp declines following the Fed’s action.

Brent crude futures traded up a shade at $54.33 per barrel, having lost some of the ground overnight made earlier in the week that had taken it a 1 1/2-year high.

Gold dropped to its lowest in more than 10 months around $1,135.1 an ounce and last stood at $1,138.

“The outlook for gold is not particularly great,” said ANZ analyst Daniel Hynes.”

The more hawkish comments from the Fed are clearly a headwind in the short-term. The selling seen this morning is just the start of things to come.”

graph