A pause in the rally in US bond yields ahead of December’s Federal Reserve meeting and stronger-than-expected Chinese data lifted emerging market equities yesterday, although Russian assets eased off the highs hit earlier this week.

US Treasury yields hit a two-year high on Monday, spiking on expectations that president-elect Donald Trump will pursue expansionary fiscal policies that will drive growth and inflation.

This steepening of the US yield curve has created headwinds for emerging market assets, but selloff has paused before the Fed starts its two-day meeting that will almost certainly raise interest rates by 0.25% — its first increase in 2016

This allowed the benchmark emerging stocks index to rise 0.3%, with strong gains in emerging Europe and selective Asian markets.

Some of the equity outperformers included Poland, up around 1%, Turkey, up 0.7% to one-month highs and South Korea, up 0.4% to one-and-half-month highs.

“Emerging market stocks are taking some comfort in the fact that the selloff in US bond markets that caused yields to rise quite significantly — normally a negative for emerging markets — is showing signs of stabilisation ahead of the Fed meeting,” said Jakob Christensen, head of emerging markets research at Danske Bank.

But Christensen said markets wanted to see what the Fed makes of Trump’s planned stimulus and higher commodity prices, especially after oil’s surge to 18-month highs following Opec’s deal with some other producers to cut output.

“It’s very important to see what the Fed communicates, and whether they are more hawkish in that light,” he said, noting that the market had priced in two hikes next year. The yield premium paid by emerging sovereign dollar debt over US Treasuries on the JPMorgan EMBI Global Diversified index was one basis point wider at 346 basis points (bps), but close to one-month lows of 343 bps hit on Friday.

Investor sentiment towards emerging markets was also boosted by better-than-expected Chinese factory output and retail sales data for November.

Chinese mainland shares ended up a touch, struggling off a one-month low hit on Monday.

The yuan also firmed against the dollar after the central bank set the midpoint rate firmer than the previous fix.

But other currencies failed to make headway with the Russian rouble slipping slightly against the dollar after leaping 2.4% on Monday to its strongest in over a year.

The rouble has been supported by the oil rebound, which has also helped Moscow shares to record highs.

Russian stocks were down 0.4% on Monday.

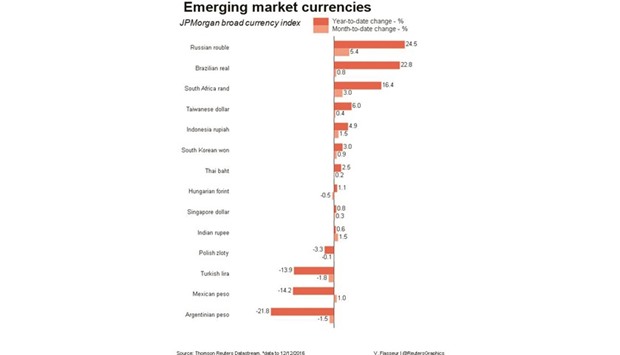

The rouble has now overtaken the Brazilian real as the best emerging currency performer of 2016 and is widely expected to appreciate further.

“The rouble remains an attractive currency...due to the prospect of relatively stable oil prices, a high interest rate differential, improvement in economic activity and stability in domestic politics at a time when Europe faces major political risk events in 2017,” Rabobank told clients.

The Kazakhstan tenge was also down 0.4% and the South African rand slipped 0.2%.

The Romanian leu weakened 0.3% against the euro but Bucharest stocks rose 0.4%, following a victory for the leftist Social Democrats in a parliamentary election.

The Azerbaijan manat was 0.1% weaker, not far off record lows, after the central bank unveiled plans on Monday to fully float the currency in 2017.

.