Opec has reached an agreement to cut its oil output by almost 1.2mn bpd and been rewarded with an increase in nearby futures prices of around $5 per barrel.

Saudi Arabia is likely to provide around half of the real cuts, and Gulf Opec members most of the rest, with a high degree of expected non-compliance by other Opec and non-Opec countries.

Past experience shows Saudi Arabia and its allies have usually done almost all the real cutting while other Opec and non-Opec members have been left to produce as much as they can.

Nevertheless, the deal has enabled the Saudis to claim they are not shouldering all the burden of rebalancing the market on their own.

Saudi Arabia’s output will return to levels similar to the start of 2016, before the kingdom raised its production over the summer.

Importantly for Saudi Arabia, the deal basically freezes production by Iran, Iraq and Russia, so the kingdom can argue its own cuts are not simply allowing rivals to continue raising their own output.

If the Saudis and their allies follow through on their commitments, and there is no reason at this point to think they will not, the deal will remove real barrels from the market and hasten the drawdown in stocks.

The deal will probably cut production by between 750,000 bpd and 1mn bpd, accelerating the rebalancing process, though to have a big impact the cuts will need to be extended into the second half of 2017.

The big question is whether higher oil prices will encourage an increase in US shale production, which would gradually undermine the effectiveness of the agreement.

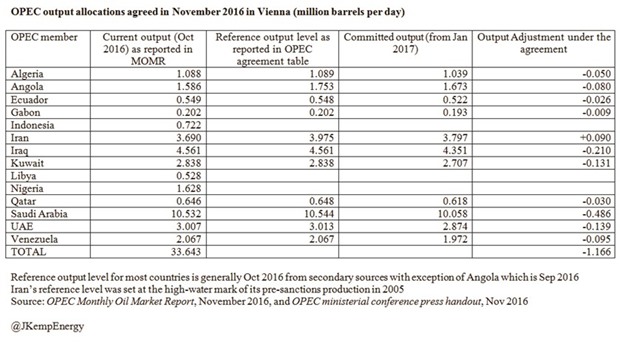

If the cuts are implemented in full, Opec output will fall by around 1.17mn bpd from 33.64mn bpd in October 2016 to around 32.5mn bpd in January 2017.

Saudi Arabia has agreed to cut its own production by 486,000 bpd with cuts by the UAE (139,000 bpd), Kuwait (131,000 bpd) and Qatar (30,000 bpd).

Cuts by these four core Opec producers total around 786,000 bpd and are the critical part of the agreement since all four countries have a good track record of complying with previous deals.

The agreement also contained pledges of 4.5% cuts from other members including Algeria (50,000 bpd), Angola (80,000 bpd), Ecuador (26,000 bpd), Iran (178,000), Iraq (210,000) and Venezuela (98,000 bpd).

But to obtain the agreement, Opec had to show some creativity around the baselines from which the cuts are calculated.

In most cases, the reference level from which cuts are calculated is actual production during October 2016, as reported by secondary sources.

But Angola’s reference level was backdated to September 2016 to take account of scheduled maintenance which lowered output in October.

Iran’s reference level was backdated even further to the middle of 2005, the high-water mark of its production before the imposition of sanctions.

Iran’s notional cut of 178,000 bpd was calculated from the high-water mark of 3.975mn bpd in the summer of 2005, which brings its output commitment down to 3.797mn bpd.

Since Iran only produced 3.690mn bpd in October, according to secondary sources, the “cut” of 178,000 bpd actually allows the country to increase its output by another 90,000 bpd, according to an Opec handout.

Baseline creativity allowing Iran to claim its pre-sanctions market share is being respected, while Saudi Arabia can claim Iran has shouldered its share of the production-cutting burden.

Indonesia, which is a net oil importer, was unable to accept a 4.5% cut so its membership of the organisation has been suspended for the time being.

Libya and Nigeria are both exempted from cutbacks because their output has been disrupted by civil war and unrest; they remain free to produce as much as they are able.

Iraq promised to cut its output by 210,000 bpd from a baseline set by secondary sources, which was a major concession, given the country’s dispute about secondary source estimates of its production.

But the deal is almost certainly premised on the tacit understanding that Iraq will not comply fully with the cutbacks and that some non-compliance will be tolerated. Non-core Opec members, excluding Saudi Arabia and other Gulf members, have pledged notional cuts of 648,000 bpd from the reference level.

Once Iran’s special treatment is taken into account, the non-core Opec members have pledged actual production cuts of 380,000 bpd from the reference level.

Since non-core Opec members have a poor track record of complying with output agreements their pledged cuts will be heavily discounted by most market participants.

Cuts by non-core members are intended to give Saudi Arabia some diplomatic cover for reversing its earlier policy of refusing to reduce output without similar reductions from other Opec members.

Opec has in turn linked its production cuts to reductions of up to 600,000 bpd by other major non-Opec crude exporters.

Russia has said it will “gradually” reduce its production by up to 300,000 bpd but has not specified the baseline from which cuts would be implemented.

In the past, Russia has said any cuts would be made from a baseline that includes projected increases in output in 2017, so they would amount to a freeze rather than a cut.

Russia has also made any cuts conditional upon Opec adhering to its own production commitments, which gives the country plenty of scope to scale back its promised cut by citing Opec non-compliance.

In summary, the deal amounts to around 786,000 bpd of cuts pledged by Saudi Arabia and other Gulf members, plus an uncertain amount of extra cuts by non-core Opec and non-Opec.

The deal will be partially offset by increases in production from Nigeria and Libya, assuming that they can improve security around their oil installations.

Traders nonetheless seem convinced the deal will make a real difference to the supply-demand-stocks balance next year.

* John Kemp is a Reuters market analyst. The views expressed are his own.

People in News