The government and central bank yesterday announced several measures to make life easier for citizens struggling to cope with a cash crunch following a sudden withdrawal of high denomination currency notes.

These included permission to farmers to purchase seeds from state-run outlets with old Rs500 notes and a 60-day relief period for payment of housing, car, farm and other loans.

On November 8, Prime Minister Narendra Modi announced that from that midnight currency notes of Rs500 and Rs1,000 would be illegal tender.

Modi said the exercise was part of the government’s efforts to curb corruption by weeding out tax evasion and fake currency.

Replacement of the invalid currency with new Rs2,000 and Rs500 notes has been slow leading to a contraction of commercial activity in a country where 96% of all such transactions routinely take place with cash.

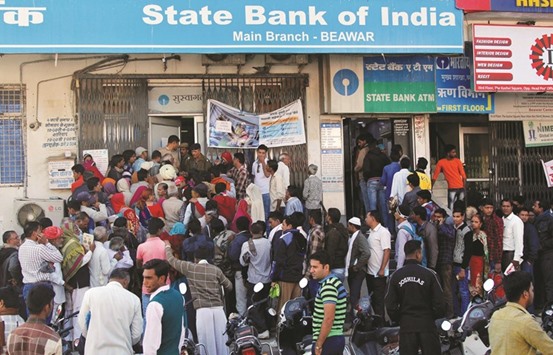

There have been long queues and frayed tempers at banks and cash machines and local media reports say the situation is worse in rural India where 70% of people live and fewer people have bank accounts or access to the Internet.

The winter crop sowing season had just begun when Modi made his announcement leading to great difficulties for farmers in acquiring seeds and fertilizers and paying farm labour.

The Finance Ministry had initially turned down requests by farmers’ co-operatives and the Agriculture Ministry but finally gave way.

Besides extending deadlines for loan repayments, the Reserve Bank of India (RBI) also eased cash withdrawal restrictions for businesses allowing them to withdraw Rs50,000 a week.

The RBI also said people can withdraw up to Rs250,000 for wedding related expenses, provided they submit adequate proof and the wedding is on or before December 30.

The cash withdrawals will be allowed out of the balance in the account as of close of business on November 8, the RBI said in a statement.

The RBI said the wedding withdrawals could be made by either of the parents or the people getting married after submitting an application.

People looking to withdraw have to also submit evidence of the wedding, including the invitation card and copies of receipts for advance payments, and a detailed list of people who will receive the cash.

Banks, till November 18 had received Rs5.45tn in the old currency notes as deposits and through currency exchange, the RBI said.

In the same period, people had withdrawn Rs1tn.

The invalid currency notes amount to 86% of the total currency in circulation in value before November 9.

Meanwhile, the cash crunch has put brakes on the country’s cotton exports, industry sources said.

Exports of 1mn bales of cotton from top producer India have been delayed after the government move prompted farmers, who prefer cash payments, to postpone sales.

The supply crunch has driven up prices in India to levels higher than in the global market and could force buyers to switch to other producers like the United States, Brazil and African countries.

It could also curb India’s total exports in the 2016/17 year marketing year that started on October 1.

“Supplies are very limited in the market. Farmers are not selling cotton right now as they need payments in cash and it is not available,” said Chirag Patel, chief executive officer of exporter Jaydeep Cotton Fibers.

The government’s move disrupted trading of farm commodities like cotton and soybean as most farmers prefer payments in cash.

“November remains a peak supply month but now supplies have stopped due to the cash crunch. We are ready to give farmers cheque, but they are insisting on cash,” said Pradeep Jain, a ginner based in Jalgaon in Maharashtra.

Expecting a bumper crop of 35mn bales, Indian traders had contracted 2mn bales for exports to China, Vietnam, Bangladesh and Pakistan for shipments in November to January.

But traders have managed to ship only around 300,000 bales and nearly 1mn bales that were due to ship in November and December are getting delayed, three exporters said.

India’s inability to ship promptly could force buyers to switch to other suppliers like Brazil and the United State, said Keith Brown, principal at cotton brokers Keith Brown and Company in Moultrie, Georgia.

People crowd the entrance of the State Bank of India branch to deposit or exchange their old high denomination banknotes in Beawar city in Rajasthan yesterday.