The recent announcement of Abu Dhabi Islamic Bank (ADIB) to enter the fintech era through a partnership with a digital-only bank is a good example how the times in the banking industry are changing also for Shariah-compliant lenders.

ADIB, one of the largest Islamic banks in the Gulf Cooperation Council (GCC), said it partnered with Fidor Bank, an Internet-only direct bank licensed in Germany, to launch what it calls the GCC’s first “community based digital bank,” targeting the region’s “millennials,” or “Generation Y,” who are looking for digital banking offerings matching their life- and working style needs.

“Our research is clearly telling us that customers are looking in particular for digital banking services that offer a seamless, easy and intuitive user experience. Our proposition will allow users to completely change the way they bank and manage their finances using digital technology to serve all their banking needs,” says Tirad al-Mahmoud, CEO of ADIB.

This is clearly a hint that Islamic banks are not exempt from the global phenomenon that the banking industry is getting inevitably disrupted by digital financial services, and this forces the entire sector to rethink its strategies and business models. For example, conventional banking giants such as Deutsche Bank, Credit Suisse, UBS, Standard Chartered, Citi or HBSC all have launched digital laboratories to develop not just online services, but inherently innovative applications that reflect the booming sharing economy, such as online communities where users can exchange financial advice and also help co-create banking products, and are experimenting with blockchain technologies for digital wallets.

Be it saving, lending, investing, insuring or paying, for every financial transaction there are new digital services in development — and the Islamic finance industry will have to follow suit if it wants to remain competitive. Research found that there is not much of a difference between the preferences of Muslims and non-Muslims with regards to digital financial services and direct banking channels. But, broken down to the GCC, consultancy EY in its World Islamic Banking Competitiveness Report 2016 says that Islamic banks still have a lower customer penetration in mobile banking compared to conventional banks.

However, new digital financial services have emerged throughout the GCC in the recent past, such as takaful online registration services and mobile bill payment applications from a number of Islamic banks. Independent projects were also emerging, such as Dubai-based Eureeca, the first crowd investing platform in the region that connects small and medium enterprises with investors for funding purposes.

In the wider region, Egypt saw the first equity-based crowdfunding platform Shekra, followed by a similar platform called Yomken, and in Lebanon the first donor-based crowdfunding platform Zoomal was launched.

Apart from crowdfunding, EY lists a number of other useful digital solutions for Islamic banks, including information services to make quick, informed financial decisions, location services to find Islamic bank branches if needed, for example for microfinance customers, online Islamic microcredit facilities, digital remittance services, online account opening and virtual advisory, online zakat, digital financial planning tools, social banking, for example for interaction with friends for opinions on products or to share banking experiences, family online banking and account control, centralised payments for obligations such as fines, taxes, utilities and phone bills, online takaful etc.

On the business-to-business level, new digital financial service solutions include digital marketing through a variety of online channels, market intelligence and analytics, online incubators, for example for halal entrepreneurs to connect start-ups with private equity and venture capital firms looking to invest in new Shariah-compliant opportunities, as well as online financial literacy training, for example through tutoring lessons or strategy games for Islamic banking customers.

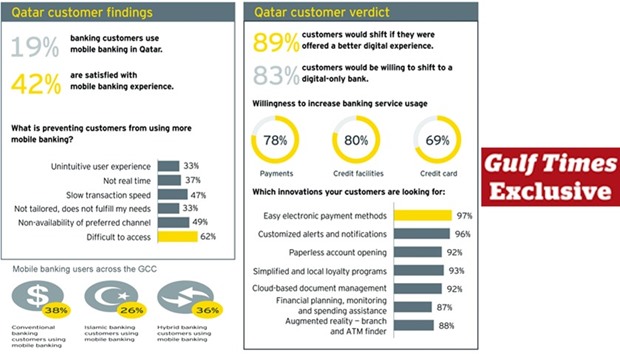

Currently, mobile banking usage in the GCC stands at 34% in the UAE, followed by 27% in Kuwait, 19% in Qatar and 15% in Saudi Arabia, according to EY, whereby the lower penetration in the two latter countries has mainly to do with accessibility and usability issues.

“It is not enough for Islamic banks to introduce new digital channels,” says EY.

“They must completely reinvent their customer processes to offer technology-enabled, simple end-to-end experiences.”

EY has found that banking customers in Qatar would particularly be interested in easy electronic banking methods and customised information through mobile banking. Among Islamic banking clients in the GCC, the penetration rate of mobile banking is lower than at conventional banks. Source: EY World Islamic Banking Competitiveness Report 2016.