When Zuzana Benesova advertised her Prague apartment on Airbnb, the online vacation home rental marketplace, she had no idea it could become a burgeoning business.

Four years later, she owns three such rental properties and runs a company which services another two dozen vacation apartments.

She also advises others who want to make use of record low mortgages to snap up properties and rent them out to holidaymakers at hefty returns.

Record low interest rates, as well as an increase in services like Airbnb, are feeding a housing frenzy in the Czech Republic, as elsewhere in Europe.

But the Czech National Bank (CNB), which wants to maintain its ultra loose monetary policy of a weak crown currency and near-zero rates until at least next year, is worried and wants more powers to keep lending from getting out of control.

Analysts and brokers, though, see little chance of the market cooling any time soon.

Newly built apartment prices in Prague rose 19% year-on-year to around 66,000 Czech crowns ($2,740) per square metre on average in the second quarter, according to a survey by construction and development firms Trigema, Skanska Reality and Central Group.

In Prague’s sought-after Letna neighbourhood, old apartments are selling before listing.

The central bank estimates Prague property prices may be 5-10% overvalued. Benesova just helped her uncle get a mortgage to buy a 60-square-metre apartment in Prague’s historic centre and estimates rental income could be as much as twice the loan payments.

“It still pays off,” she said.

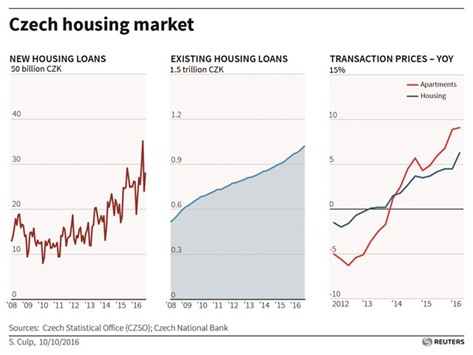

Mortgage lending grew 29% to a record 184bn crowns ($7.6bn) in 2015, according to Development Ministry statistics, and is expected to surpass that this year.

In August, the average mortgage rate dropped to 1.84%, from 2.11% the year before, market monitor Hypoindex found.

Business consultant Ondrej Homola lives in a rented flat but borrowed to buy a small apartment in Prague’s up-and-coming Holesovice district to let through Airbnb. “Airbnb rental makes business sense,” he said.

This is because property owners can make two or three times more rent through Airbnb than via long-term lettings. The number of tourists visiting Prague rose 14% year-on-year to 1.3mn in the first quarter, according to the city’s tourism agency.

Low rates are also helping first-time home buyers.

Magdalena Klimesova said a mortgage covering 80% of the purchase price enticed her to ditch her rented home for a house on a hillside by Prague’s Vltava River.

It has an 8-year fixed rate of 1.59% and payments will take up a third of her family’s monthly income.

IT consultant Matej Fryba said he bought a 120-square-metre apartment, bigger than he expected.”Low rates helped us get a larger loan than we might normally afford,” he said.

The central bank is seeking more legal powers to enable it to limit mortgage lending if needed, but has issued repeated recommendations on mortgage limits to banks.

Earlier this year, the central bank asked banks not to offer loans covering 100% of property values, and on October 1, tightened this to 95%.

From April this will shrink to mortgages at 90% of property value. For buy-to-let the ceiling is 60%.

Jan Frait, head of the CNB’s financial stability department, said the main fear is that people will take on more than they can afford and struggle with payments, forcing many to curb spending when the economy slows.

“Some households take a loan that consumes more than one third of their monthly income, which is quite striking in the situation of historical low interest rates,” he said.

The housing market has soared in much of central Europe, and the National Bank of Slovakia has put in place similar measures to curb mortgages.

Regulators in Hungary had already imposed such limits when foreign-currency loans soared as national currencies dropped during the global financial crisis. Czech banks emerged relatively unscathed from the global crunch, backed by low loan-to-deposit ratios.

Deep interest rate cuts have helped the Czech economy to grow 4.6% in 2015 when a record flow of EU subsidies also boosted growth.

Growth is expected to slow to over 2% growth this year before accelerating next year again.