The European Union has set provisional import duties on two types of steel coming into the bloc from China to counter what it says are unfairly low prices, in a move likely to anger Beijing.

The duties are the latest in a line of trade defences set up against Chinese steel imports over the past two years to counter what EU steel producers say is a flood of steel sold at a loss due to Chinese overcapacity.

Some 5,000 jobs have been axed in the British steel industry in the last year, as it struggles to compete with cheap Chinese imports and high energy costs.

G20 governments recognised last month that steel overcapacity was a serious problem.

China, the source of 50% of the world’s steel and the largest steel consumer, has said the problem is a global one.

The duties will be in place eight months after the launch of respective investigations, a month earlier than would normally be the case.

The European Commission has committed to speed up its trade defence actions under pressure from EU producers.

The Stoxx basic resources sub-index was by far the strongest component of the Stoxx 600, propelled by European steelmakers.

Shares of the world’s largest steel producer, ArcelorMittal were up 4.3%, ThyssenKrupp by 2.2%.

European steelmakers association Eurofer, which brought the complaint to the European Commission, said it welcomed the fact that the duties would be in place earlier than normal.

The duties, which will take effect today, are provisional, meaning they are in place for up to six months until the European Commission completes its investigation. If upheld, they would typically be set for five years.

No one was available for comment at a series of steelmakers in China, which was celebrating a week-long national holiday.

The duties are set at between 13.2% and 22.6% for hot-rolled flat iron and steel products and at between 65.1% and 73.7% for heavy-plate steel, according to a filing in the European Union’s official journal.

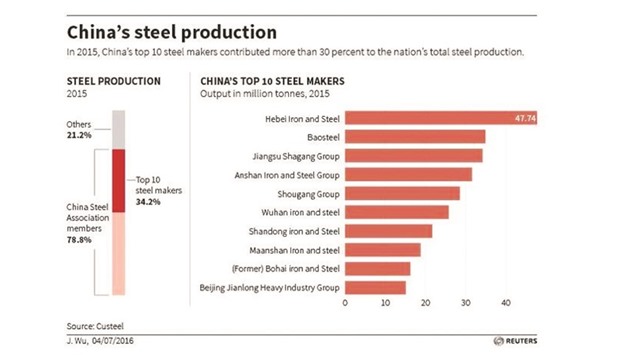

The hot-rolled steel case includes Bengang Steel Plates Co Ltd and Hebei Iron & Steel Co Ltd and units of Jiangsu Shagang Group.

The heavy plate steel case covers Nanjing Iron & Steel Co Ltd, Wuyang Iron and Steel Co and Minmetals Yingkou Medium Plate Co Ltd.

Eurofer said Chinese producers’ share of the EU market in heavy-plate steel, used in construction, mining and shipbuilding, grew to 14.4% in 2015 from 4.6% in 2012, while the average price dropped by 29% over the same period.

For hot-rolled, the market share grew to 4.3% from below 1% over the same period, while import prices fell by about 33%. European producers of hot-rolled steel include ThyssenKrupp, Tata Steel and ArcelorMittal, while heavy-plate is made by Tata and two unlisted German companies.

The European Commission is also investigating alleged dumping of hot-rolled steel producers in Brazil, Iran, Russian Federation, Serbia and Ukraine.