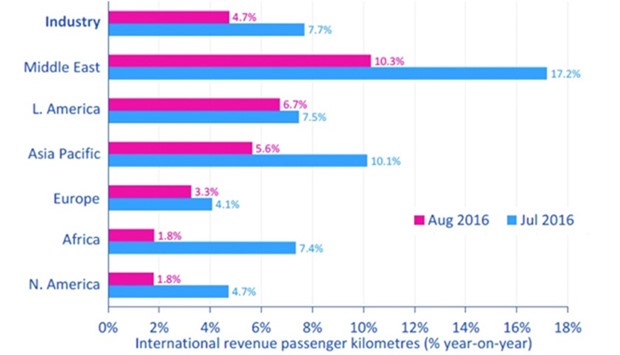

Annual growth in international revenue passenger kilometres (RPKs) flown by Middle Eastern airlines dropped in August but stayed in double digits (10.3%), IATA said in its latest air passenger market analysis.

“The strong upward trend in traffic remains in place,” IATA said. However, passenger capacity growth has continued to outstrip that of demand; indeed, load factors on the largest routes to and from the Middle East, those between Asia and Europe, fell by 2.3 and 3 percentage points respectively in the first seven months of 2016, compared to the same period in 2015, and both registered period-lows.

Annual growth in industry-wide RPKs slowed to 4.6% year-on-year in August, from an upwardly-revised 6.4% in July. Airlines from the Middle East and Asia Pacific regions posted the fastest traffic growth for the third month in a row, but African airlines found themselves at the bottom of the growth chart for the second time in three months.

Developments in industry-wide traffic growth continue to reflect the net impact of a range of competing drivers. On the one hand, growth has faced a number of headwinds, not least from high-profile terrorist attacks and political instability in parts of the world.

“Encouragingly, the trend in European international traffic picked up in August, which suggests that conditions are getting back to normal after the disruption in the region this year. Asian passengers still look to be being put off by terrorism in Europe, though, and it appears that they are substituting leisure travel to destinations closer to home,” IATA noted.

Meanwhile, although global business confidence has picked up in recent months, the global economy remains fragile and uncertain, with economic policy at a crossroads, it said.

On the other hand, air passenger demand has continued to be supported by lower airfares, which reflect lagged effects of lower oil prices, as well as wider competitive pressures in the market. Downward pressure on underlying yields actually intensified during the first five months of 2016, but there are tentative signs that this eased in the most recent data.

As IATA has noted before, the negative influences on demand growth have tended to dominate throughout 2016 so far, and momentum in the wider market has eased.

Adjusting for the fact that 2016 was a leap year, IATA estimates that industry-wide RPKs grew by 5.4% this year to date, compared to 6.4% in the same period of 2015.

But, IATA said, “The bigger picture remains that passenger traffic this year has still grown broadly in line with the average pace seen over the past decade or so, and is set for another year of solid growth in the year as a whole.”