Middle Eastern carriers saw air freight demand slump to 1.8% year-on-year in August — the slowest pace since July 2009, IATA said in its latest air freight report.

Capacity increased by 6.9%. The strong upward trend seen in Middle Eastern traffic over the past year or so has halted.

In seasonally-adjusted terms, volumes in July 2016 were slightly below those seen in January 2016. The weakening performance is partly attributable to slower growth between the Middle East and Asia. This suggests that Middle Eastern carriers are facing stiff competition from European airlines on the Europe-Asia route, IATA said.

IATA data for global air freight markets in August showed that demand, measured in freight tonne kilometres (FTKs), rose 3.9% year-on-year.

Freight capacity measured in available freight tonne kilometres (AFTKs) increased by 4.1% over the same period. Load factors remained historically low, keeping yields under pressure.

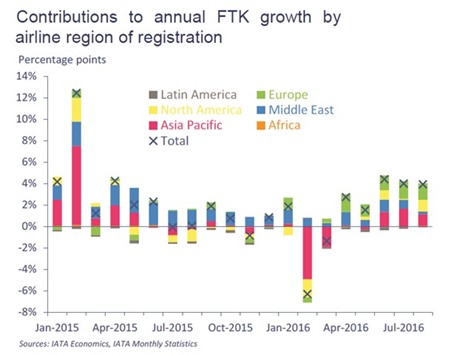

Industry conditions have improved since the particularly soft patch at the start of the year. Carriers in all regions except Latin America reported an increase in year-on-year demand in August. However, regional results varied considerably.

For the third time in four months airlines based in Europe posted the highest collective annual growth of all regions, while airlines in the Middle East experienced their slowest growth in more than seven years.

Industry-wide conditions have improved from the weak patch seen in the first quarter

of 2016, IATA said.

Routes to, from and within Asia in particular are doing well, in keeping with reports from the industry, and overall freight volumes are trending upwards in seasonally-adjusted terms at a moderate, if not stellar, pace.

There are a few reasons for cautious optimism in the near term, particularly following the collapse of the container shipping firm Hanjin at the end of August, IATA said.

Other container shipping firms appear to have seen the biggest boost to demand so far (container shipping rates have risen sharply).

But there is the potential for freight forwarders to turn to air cargo during the peak season of product launches and deliveries of new product lines, which may provide a one-off boost to air cargo similar to that seen during the disruption at seaports on the US west coast in early 2015.

The uptick in the new export orders component of the global purchasing managers’ index back into expansionary territory in recent months also offers some encouragement for airfreight over the months ahead.

IATA’s director general and CEO Alexandre de Juniac said, “August numbers showed improvements in cargo demand. While this is good news, the underlying market conditions make it difficult to have long-term optimism. World trade volumes fell by 1.1% in July with no improvement on the horizon. And the current global political rhetoric in much of the world is more focused on protectionism than trade promotion. Economies need to grow out of the current economic doldrums. Governments should be focused on promoting trade, not raising protectionist barriers.”