A handful of European tech firms are testing the appetite for initial public offerings, taking their lead from a modest rebound in listings in the United States following a two-year slump.

Danish credit card payments processor Nets and Dutch online food ordering firm Takeaway.com plan to list on their home markets this month while Spanish mobile phone tower business Telxius and German online pharmacy Shop Apotheke Europe are eyeing initial public offerings (IPOs) in October.

According to data from venture market research firm CB Insights, European tech IPOs have been thin on the ground in recent months while venture capital has also crumbled.

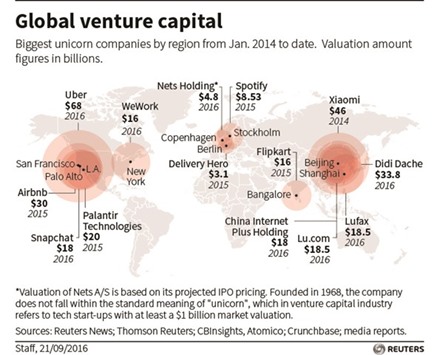

The rush last year to mint “unicorns” — firms valued at more than $1bn — led to a worldwide crash in venture capital funding that is continuing to drag on the creation of new start-ups, especially in Europe, while weighing on stock markets.

The market for new tech listings in Europe retreated from five IPOs in the second quarter of 2015 to just one a quarter later and it has attracted only modest interest since then, with many planned listings being cancelled.

While not yet a flood of household names, larger tech firms in Europe are watching the upcoming listings to see if prices hold up enough to justify their own IPOs, rather than letting investors cash out through a merger with a bigger company. “The market is in a place where quite a few European companies can see IPOs happening at a premium compared to their last investment rounds,” said London-based venture investor Alexander Frolov at Target Global.

“The question is whether the situation will continue for a while and whether the market has appetite for further IPOs, or whether prices go back down,” he said.

Frolov was an early backer of Germany’s Delivery Hero, Takeaway.com’s larger rival, which is considered an eventual candidate for a stock market listing. On Friday, Nets is looking to raise $1.5-$2.5bn in a deal that could value the Danish firm as much as $4.8bn.

Next week, Takeaway.com is aiming to raise up to €350mn for a market value of up to €1.2bn.

Early next month, Telxius, the mobile tower business that Telefonica is spinning off, will be looking for a market value of €3-3.75bn while Shop Apotheke Europe is planning a more modest €100mn offering valuing the company at about €300-400mn.

There is a vital interplay between successful IPOs and getting investors to make bigger bets on European tech firms.

Europe remains a hot-bed of very early stage “seed” investments, typically under 1 mn euros or pounds, which account for 49% of all funding rounds in Europe, far more than in other regions.

But the region lags well behind the United States and Asia in terms of larger investments for companies looking to expand.