ECB bond-buying appears to be losing its potency in Portugal just when the country most needs the backstop it provides.

Portugal’s economic growth is lacklustre, its banking sector weak and its coalition government at odds with Brussels over the budget deficit.

To top it all, jittery markets are counting down to a vital ratings review on October 21.

DBRS is the last major ratings agency to give Portugal the investment grade rating it needs to qualify for the European Central Bank’s bond-buying programme.

Last month DBRS warned pressures were building on Portugal’s creditworthiness, stoking concern about the ratings outlook.

ECB asset purchases, which have topped the 1tn euro mark, help contain volatility at times of heightened risk aversion and uncertainty — for instance in the days after June’s shock decision in Britain to leave the European Union.

But the central bank has been buying fewer bonds in Portugal than its rules allow because it faces a scarcity of eligible securities, in effect reducing the impact of its purchases.

While the ECB also faces a scarcity of eligible bonds in countries such as Ireland, Finland and Germany, Portugal is especially vulnerable, analysts say.

“The QE safety net is becoming thinner for Portugal,” said Richard McGuire, head of rates strategy at Rabobank.”Slow growth, a less than efficient governing arrangement and the looming DBRS review are challenging sentiment at the very juncture that the alternative demand that might have been present via QE is ebbing.” ECB rules mean the central bank cannot own more than 33% of any single bond issue or of a country’s total debt.

Deutsche Bank estimates ECB purchases of Portuguese government bonds amount to €1.5bn a month, a reasonably significant amount relative to the €112bn Portuguese bond market.

ING senior bonds strategist Martin Van Vliet reckons the ECB already owns 27% of Portuguese bonds.

“If they buy at the pace they should buy they will run out of eligible Portuguese bonds by the end of the year,” he said. UBS estimates that purchases of Portuguese bonds have been below the ECB’s monthly targets for five successive months.

The pressure on Portuguese bonds has been exacerbated by signs the ECB is in no rush to address bond scarcity.

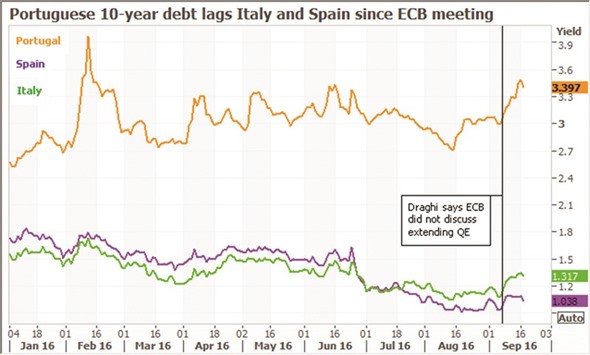

Ten-year yields have spiked to their highest levels in 2-1/2 months since the ECB said on September 8 it did not discuss an extension to bond purchases, upending market expectations for an extension or tweaks to address a shortage of eligible bonds.

Since the ECB meeting, Portuguese government bonds have underperformed eurozone peers, with 10-year yields up 25 basis points at around 3.33%.

“Most people assumed the ECB would tackle those scarcity issues at the September meeting and they didn’t,” said Mizuho strategist Antoine Bouvet. “We are heading into a period of more volatility for peripheral bonds and that is especially true for Portugal.”

The Bank of Portugal, which buys Portuguese bonds for the ECB’s asset-purchase programme, said this week that purchases of public debt for QE are not close to reaching any limits and will continue until at least March 2017 — when the scheme is scheduled to end.