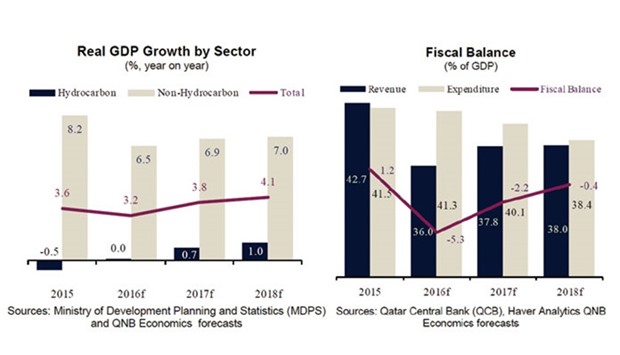

The ramp up in investment spending and initial gas production from the Barzan gas project will accelerate Qatar’s real GDP growth to 3.8% in 2017 and 4.1% in 2018 from 3.2% this year, QNB has said in its ‘Qatar Economic Insight’.

The report by QNB Economics examines recent developments and the outlook for the Qatari economy as it continues its strong growth based on non-hydrocarbon investment spending.

According to QNB, Qatar’s economy has weathered low oil prices due to strong macroeconomic fundamentals including a low fiscal breakeven price, the accumulation of significant savings from the past and low levels of public debt.

Oil prices are expected to recover over the medium term; averaging $44.7 for barrel in 2016, before rising gradually to $55 in 2017 and $57.9 in 2018 as declining US oil production and steady demand growth are expected to reduce excess supply, the QNB report said.

Lower hydrocarbon revenue and continued capital spending by the government are expected to result in modest deficits in 2016 and 2017, but the rebound in oil prices should gradually bring the government back to near balance by 2018.

Revenue is expected to decline in 2016 due to the weakness in oil prices and slower non-hydrocarbon growth, but should pick up over the medium-term due to the introduction of a 5% value-added tax in 2018.

The government is expected to continue its investment spending programme while rationalising current spending, leading to a modest decline in expenditure as share of GDP from 2016 to 2018.

The current account surplus is expected to fall to 4.1% of GDP in 2016 before rising to 6.6% in 2017 and 6% in 2018 mirroring the projected movement in oil prices, given that hydrocarbons account for more than two-thirds of Qatari exports.

Qatar’s international reserves are expected to be maintained at just below $40bn, or around seven months of prospective import cover, QNB said.

Inflation is expected to rise to 3.2% in 2016 and 3.4% in each of 2017 and 2018 in line with the pick-up in global inflation.

International inflation is expected to rise on stronger food and oil prices while population growth should support domestic inflation, QNB said.

Business / Eco./Bus. News

Investment ramp up, Barzan output to lift Qatar real GDP growth to 3.8% in 2017: QNB

INVEST