The oil price decline has fuelled a plethora of debt issues by GCC sovereigns and Qatar issued $9bn in the capital markets so far this year, S&P Global has said in a report.

Saudi Arabia issued $10bn via a syndicated loan from international lenders, while Abu Dhabi issued $5bn in the capital markets. S&P Global anticipates more issuance in this quarter and next.

In S&P’s view, these large issues may have constrained issuance by both government related entities (GREs) and private corporations and projects (for example, GCC corporate and infrastructure bond issuance dropped to $5bn year-to-date from $6.3bn in the same period in 2015).

These issuers have also faced less pressing refinancing needs after deleveraging in 2011-2014, when commodity prices were higher.

In addition, a number of large infrastructure projects in the GCC (Gulf Cooperation Council) have either been cancelled or deferred amid governments’ attempts to control expenditures and address fiscal challenges. Fewer projects have broadly eased funding needs, including in the capital markets.

S&P estimates that Gulf government spending on projects alone – including infrastructure contracts awarded over 2016-2019 – could be about $330bn. It noted that with some sovereigns, such as Saudi Arabia, the 2016 budget includes a capital spending allocation of about 9% for what the government defines as “transport and infrastructure.”

Taking this and other research into account, S&P estimates that about $50bn out of the $330bn that it thinks will be spent on projects will be allocated specifically for infrastructure (including transport-related projects).

This compares with its estimates of about $604bn in projects (including $100bn of infrastructure projects) that will need funding through 2019.

Qatar’s largest projects are in pre-execution phase and include QRail, a rail connection between Qatar and neighbouring countries ahead of the 2022 FIFA World Cup.

“We expect some pressure on governments to defer and cancel discretionary projects to control expenditures in the current GCC economic climate. This will reduce the pool of projects and infrastructure requiring funding. However, we think that out of the remaining pool of eligible project and infrastructure corporate financings, sukuk as a form of financing (in tandem with conventional project and infrastructure) present a viable funding tool,” S&P said.

Sukuk, being an asset linked form of funding, lends itself naturally as a funding tool for financing essential infrastructure. With governments placing a greater onus on sharing the burden of infrastructure spending with the private sector through, for example, the introduction of greater flexibility around public private partnership (PPP) laws in Dubai, Oman, and Qatar, sukuk can provide a form of funding that is suited to PPP-based projects.

S&P thinks that infrastructure sponsors may be considering a number of asset-backed sukuk structures, including green project sukuk as a means for funding energy-related assets. For instance, Saudi Arabia-based issuers Sadara Chemical Company issued a $2bn equivalent asset-backed sukuk in 2013 and downstream energy company Satorp issued a $1bn asset-backed sukuk in 2011.

These sukuk would be, in S&P opinion, well suited to funding long-term infrastructure and could lead to important innovation in the market.

S&P expects corporate entities’ refinancing needs will remain significant, with $23.6bn in terms of capital market financings coming due ($11.9bn of corporate sukuk and $11.75bn of corporate bonds) between 2017 and 2019.

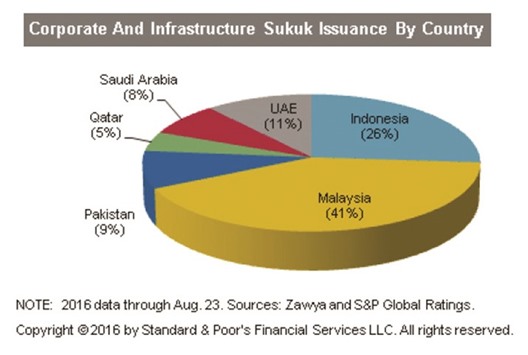

Corporate and infrastructure sukuk issuance is likely to remain volatile and difficult to predict in the short term, mainly hinging on the specific needs of existing sukuk issuers in the GCC and Malaysia.

S&P also thinks that absent important government strategies to promote sukuk, corporate and infrastructure issuers will remain relatively comfortable switching back and forth between sukuk and conventional issuance depending on prevailing conditions, especially pricing and maturity terms.

..