Emerging-market stocks and currencies trimmed the biggest weekly gain in a month after the European Central Bank refrained from pledging more stimulus and North Korea conducted its biggest-ever nuclear test.

The won dropped and the Kospi index suffered its worst retreat for two months after North Korea’s fifth nuclear test. South Africa’s rand, Malaysia’s ringgit and Russia’s ruble fell as Brent crude slid the most in more than a week. South African and South Korean sovereign bonds retreated after ECB President Mario Draghi damped expectations he’ll expand asset purchases beyond March. Turkish debt declined as data showed economic growth slowed in the second quarter.

By downplaying the likelihood for additional stimulus, the ECB’s decision raised questions about how much further the emerging-market rally can run as stocks trade near 14-month highs and bond yields remain close to the lowest levels since 2013. Investors are also looking for clues on when the Federal Reserve will start raising interest rates again, staunching flows to funds seeking higher returns in developing nations.

“Today there is some small profit taking after the ECB didn’t promise any additional measures,” said Hertta Alava, head of emerging markets at FIM Asset Management in Helsinki, who favours stocks in Hong Kong and Russia. “Monetary policy globally is still very stimulative, so I don’t see this as a turning point.”

Emerging-market debt and equity funds registered the 10th straight week of inflows in the period ended September 7, Bank of America Merrill Lynch said in a note yesterday, citing EPFR Global data.

The MSCI Emerging Markets Currency Index declined 0.7% in London, heading for a five-day gain of 0.7%. The Bloomberg Dollar Spot Index, which tracks the greenback against 10 peers, was little changed after rising 0.4% on Thursday.

Russia’s rouble dropped for the first time this week, shedding 0.5%, as Brent crude shed 1.3% in London. Poland’s zloty was steady against the euro ahead of a Moody’s Investors Service review of the country’s credit rating.

Taiwan’s dollar weakened 0.6%, South Africa’s rand declined 1.2% and the won closed down 0.7%.

“South Korea’s won fell more so than the others as news of North Korea’s nuclear test heightened the region’s geopolitical risks,” said Seo Jeong Hun, a currency analyst at KEB Hana Bank in Seoul “Eyes will be on data or comments coming out from the US next week as investors try to gauge timing of the rate hike.”

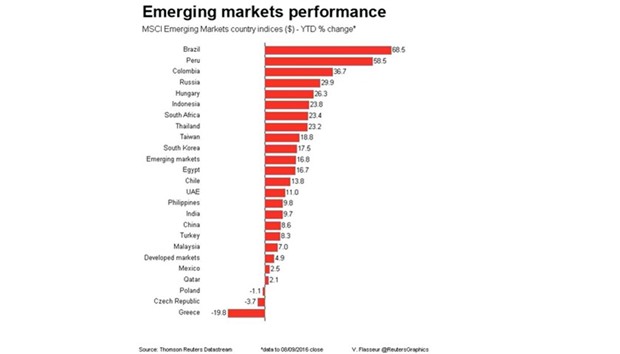

The MSCI Emerging Markets Index fell 1.2%, reducing its gain this week to 1.9%. Information-technology and consumer shares led declines.

The Kospi Index dropped 1.3% in South Korea, the most since July 6. BGF Retail Co dropped 12% in Seoul after EToday reported the company’s chairman said he was seeking to sell his 3% stake.

The premium investors demand to own developing-market bonds over US Treasuries fell one basis point to 323.

Turkey’s 10-year yield increased 15 basis points to 9.72% after the statistics bureau said gross domestic product grew 3.1% in the April-to-June period, compared with 4.7% in the previous quarter. The yield on South Africa’s comparable maturity climbed 12 basis points to 8.74%.