US gasoline stockpiles remain at record highs for the time of year but excess inventory is smaller than it appears once adjusted for the higher level of domestic consumption and exports.

Stocks of gasoline and blending components stood at 232mn barrels near the end of August, down from a high of 259mn in February but well above the 214mn reported at the same point in 2015.

Persistently high levels of gasoline inventories have led many analysts to warn about a “gasoline glut” that could force significant cutbacks in refinery crude demand in the autumn weighing on oil prices.

But stockpiles look more reasonable when compared with the record level of gasoline consumption at home and strong exports to Mexico and the rest of Latin America.

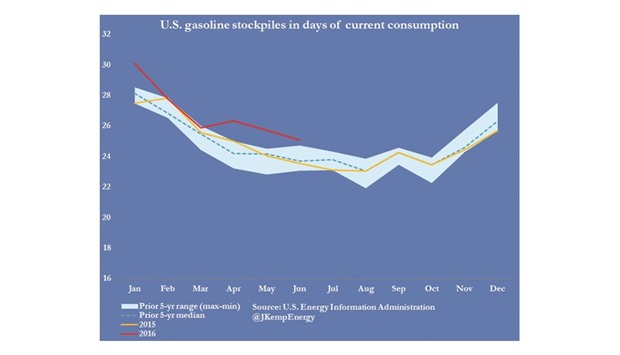

Gasoline stockpiles exhibit strong seasonality and tend to be highest relative to consumption in winter and lowest in summer.

Refiners use storage to optimise capacity utilisation and smooth the swing from off-peak to peak demand between winter and summer.

Gasoline stocks started the year at more than 30 days worth of consumption in January, the highest level since January 1999.

By the end of June, stocks had fallen to just 25.1 days of consumption, compared with an average of around 23.7 days over the previous five years.

Once adjusted for the increase in consumption, the difference between actual gasoline stocks and the level over the previous five years was around 13mn barrels.

Since then, gasoline stocks have fallen further to 24.4 days of consumption at the end of August, according to the new weekly consumption estimates published by the US Energy Information Administration.

Gasoline stocks were still around 13mn barrels higher than normal for the time of year once adjusted for increased consumption.

But the US refiners have succeeded in controlling stockpiles, mostly by holding refinery run rates unchanged from last year, or even cutting them, and letting strong consumption and exports to soak up the excess.

Around 13mn barrels is a rather modest “glut” and should be relatively easy for the market to carry and for refiners to work down in the year ahead.

Refinery crude processing rates are expected to be slightly lower during the winter of 2016/17 than they were during winter 2015/16, but the difference is likely to be fairly small.

The negative impact on crude demand and prices is likely to be minor, given the enormous scale of the global market.

The impact on distillate supplies, a co-product of gasoline making, and a much smaller market, could be more significant, as lower gasoline production implies a reduction in distillate output.

John Kemp is a Reuters market analyst. The views expressed are his own.