Emerging market equities edged higher yesterday but stayed on track to end the week in the red as investors positioned for US jobs data and political tensions hit South Africa’s rand and bonds.

An emerging market rally has run out of steam in the past couple of weeks as more bets have been laid on a US interest rate increase before the end of the year.

“Everyone is laser-focused on payrolls — the concern from an EM side is just exactly where the (Federal Reserve)...gets re-priced on the back of this,” said Rich Kelly, head of global strategy at TD Securities.

“It is not about growth, it is not about anything there — it is simply about whether US interest rates are going up.” A disappointing payrolls number would support emerging markets, said Kelly, but anything stronger than 200,000 could put a September hike back on the agenda.

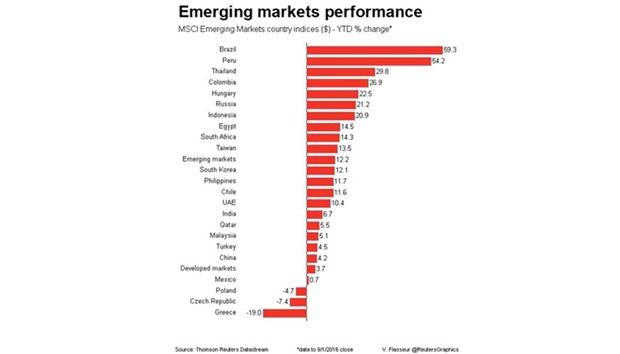

The benchmark emerging equity index rose 0.3% on the day but was set to end the week down 0.8%, its second straight week of losses. Emerging markets portfolio inflows fell to just under $25bn in August from nearly $30bn in July, the Institute of International Finance said on Thursday.

Most Asian and emerging European markets made gains on the day, with Chinese mainland and Hong Kong shares up around 0.4%, while Turkish stocks and Russian dollar-denominated shares were up around 0.3%.

Currencies were mixed, with South Africa’s rand among the biggest losers, weakening 0.5% against the dollar, and on track to end the week down 2%.

South African assets have been pressured by an investigation into whether Finance Minister Pravin Gordhan — who is popular with businesses and investors — used a surveillance unit set up when he was head of the tax service to spy on politicians.

“The (ruling) ANC is effectively at war with itself, and because the country faces many economic challenges, it is impossible to address them,” said Richard Segal, emerging markets credit analyst at Manulife Asset Management in London.

Reflecting these worries, the yield premium paid by South African sovereign bonds over US

Treasuries on the JP Morgan EMBI Global has risen 23 basis points (bps) over the week to 308 bps, its widest since early July.

The cost of insuring South African debt against default has also risen, adding 17 bps over the week to 261 bps, according to Markit data, the highest since July 11.

The Russian rouble fared better, firming 0.25% against the dollar, but still 1.8% weaker for the week after oil prices tumbled nearly 9% over the same period, Brent crude’s worst week since January.

The Brazilian real firmed 0.4% and was on course to end the week in the black after Brazil’s Senate voted to impeach former president Dilma Rousseff.

Ukraine’s restructured dollar bonds rose slightly across the curve after the International Monetary Fund said it was close to concluding its latest review of Ukraine’s bailout and expects its board to consider releasing additional funds in the second half of September.

Emerging Europe currencies were mainly weaker against the euro, with the Polish zloty leading the fallers, down 0.6% to trade at six-week lows.