European stock markets rebounded yesterday, driven by improving eurozone data and signs that the initial impact of Britain’s shock EU exit vote may not be as bad as feared.

Investors were also looking to a speech on Saturday from Federal Reserve boss Janet Yellen for insights into the state of the US economy and any plans for an interest rise.

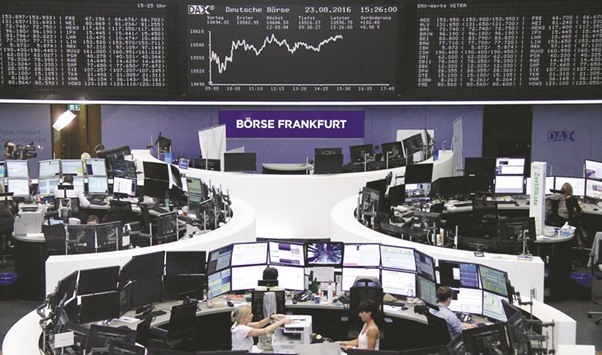

At the close, Frankfurt’s DAX 30 stocks index had added 1.0% and the Paris CAC 40 gained 0.7% while London’s main FTSE-100 index rose 0.6%.

Wall Street was also in positive territory, despite trader caution ahead of Yellen’s speech at the annual global central bankers’ symposium in Jackson Hole, Wyoming.

Mid session, the Dow Jones Industrial Average was up 0.2% at 18,573.25 points while the broader S&P 500 and the tech heavy Nasdaq Composite both added 0.4%.

The euro meanwhile rose against the dollar.

“The eurozone recovery continues to weather the Brexit shock rather unscathed,” said Edoardo Campanella of UniCredit Research.

“All in all, today’s survey is reassuring, although uncertainty about future growth developments remain high.”

Data monitoring company Markit said the eurozone economy maintained its resilience this month despite Britain’s shock June 23 vote to leave the EU — with a strong showing from France as well as powerhouse Germany.

Markit said the preliminary August reading for its Composite Purchasing Managers Index (PMI) for the eurozone rose to a seven-month-high of 53.3 points, up from 53.2 in July.

Capital Economics suggested that while “it is still early days...

this builds on some other recent evidence that the initial impact of the referendum result, though negative, may not have been as bad as many feared.

But the firm did worry that sagging eurozone consumer confidence would hit household spending growth based on a second-quarter slowdown in retail sales growth.

“Looking ahead, we expect household spending growth to continue to slow, as the boost to consumers’ real incomes from the previous large falls in energy prices fades,” Capital Economics forecast.

Widespread worries that the vote to exit the EU will hamper growth in Britain and beyond have eased in recent weeks thanks to better-than-expected economic data.

“Of course this might just be the calm before the storm,” said Wilson, warning that if unemployment rose as expected the outlook would be rather less rosy.

Elsewhere, shares in Germany’s embattled car giant Volkswagen closed up 2.4% at €122.9 after the group reached a deal with suppliers to restart deliveries — after a row over contracts forced VW to halt production at several plants.

In Asia yesterday, share prices of energy firms sank as oil prices extended the previous day’s sharp losses.

In London, the FTSE 100 up 0.6% at 6,868.5 points; Frankfurt — DAX 30 up 1.0% at 10,592.9 points and Paris — CAC 40 up 0.7 % at 4,421.4 points at the close yesterday.

Traders work at the Frankfurt Stock Exchange. The DAX 30 closed up 1.0% to 10,592.9 points yesterday.