Emerging-market stocks and currencies rose for the first time in three days as investors bet an environment of low interest rates will continue to drive the search for higher yields. Turkish bonds rallied after the central bank cut interest rates.

The yield on 10-year Turkish notes fell for the first time in five days after the central bank lowered its overnight lending rate by 25 basis points. The won joined South Africa’s rand in leading gains among peers as investors assessed the path of Federal Reserve policy before Chair Janet Yellen’s speech August 26 at Jackson Hole, Wyoming. PZU dropped to a record low after a report said executives will fly to Milan to negotiate the terms of purchasing Poland’s Bank Pekao from UniCredit SpA.

A third monthly gain in stocks and currencies have come under threat amid increased bets for US policy tightening this year, after New York Fed President William Dudley last week said markets may be underestimating the odds and Dennis Lockhart of Atlanta said accelerating economic growth may warrant at least one increase in 2016. Investors are now waiting to see if Yellen will use her Wyoming speech to signal an imminent move.

“Price action will remain driven by Jackson Hole expectations and general central bank rhetoric,” said Simon Quijano-Evans, emerging-market strategist at Legal & General Investment Management in London. A lack of “meaningful” gain in global interest rates “keeps the hunt for yield in emerging markets going in spite of temporary hiccups like domestic politics,” he said.

The MSCI Emerging Markets Currency Index rose 0.4% in London. The South Korean won added 1%, the steepest advance among emerging-market peers, followed by a 0.8% increase in the rand.

Turkey’s lira kept gains after central bank cut the overnight lending rate by 25 basis points to 8.5%, matching the median estimate in a Bloomberg survey.

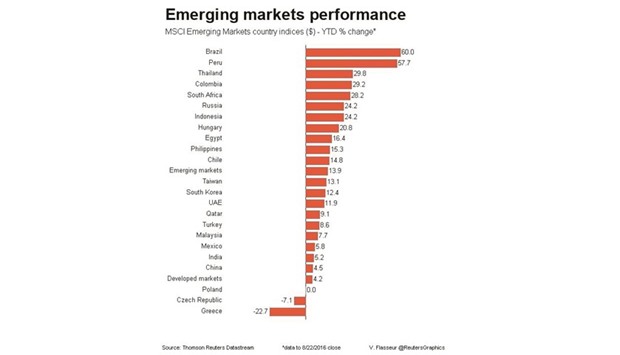

The MSCI Emerging Markets Index rose 0.3%, ending a 1.3% two-day loss. Samsung Electronics Co contributed the biggest boost to the gauge with technology and consumer-staples companies leading gains.

LG Household & Health Care advanced 6.5% amid optimism sales will rise after data showed Chinese tourists visiting South Korea increased threefold in July from a year earlier.

PZU fell 3.5% and Bank Pekao slid 2.9% after Polish newspaper Dziennik Gazeta Prawna reported that the heads of PZU and the state-run Polish Development Fund will fly to Milan to negotiate the terms of a Bank Pekao purchase from UniCredit.

Shares in Saudi Arabia retreated 0.2% as Brent crude slid for a third day. Iraq, the second biggest producer in the Organisation of the Petroleum Exporting Countries, is in the process of boosting crude exports by about 5% after an agreement to resume shipments from three oil fields in Kirkuk.

The premium investors demand to own emerging-market debt over US Treasuries narrowed two basis points to 335, according to JPMorgan Chase & Co indexes.

.