The Bank of England’s (BoE) new easing package will not solve structural problems after the UK voted out of the European Union, QNB said in its latest economic commentary.

As expected, the BoE delivered a significant dose of monetary stimulus at its latest meeting on August 4, 2016, the QNB report said.

The stimulus package involved a 25 basis point (bp) cut to the policy rate to 0.25%, the lowest in the bank’s 322-year history, and a restarting of the quantitative easing (QE) programme to reduce interest rates on long-term government and corporate bonds.

It also included a term funding scheme with the aim of ensuring that the cut in rates is passed on to households and companies. QNB said the bank hinted that further action is likely to be warranted later this year.

The sizeable stimulus, according to the report, came in response to the worsening economic outlook in the UK following the unexpected Brexit vote. But while monetary stimulus can alleviate some of the negative effects of Brexit, it cannot eliminate the shock completely.

After all, monetary policy cannot generate new trade deals or compensate for the lost productivity or slower labour force growth that is likely to ensue in a post-Brexit Britain, QNB said.

Early signs suggest that the UK economy has experienced a broad-based slowdown since the Brexit vote. Most of the evidence takes the form of surveys, as hard data are published with a lag. But the evidence so far has been damning. Consumer confidence in July fell to the lowest level since end-2013.

QNB said Purchasing Managers Index (PMI) surveys point to shrinking manufacturing, services and construction sectors in July, with the contraction in the latter two being the largest since the global financial crisis, at least.

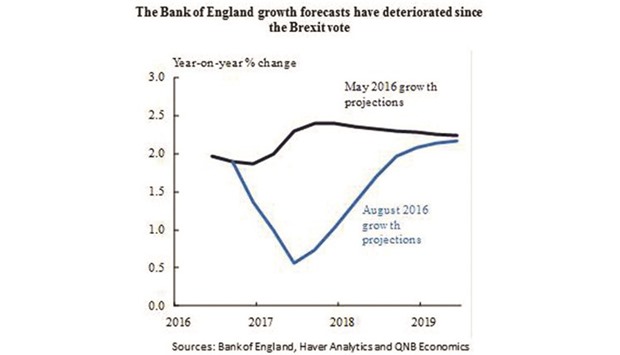

The slowdown in the economy is expected to persist, according to the report. The uncertainty shock is unlikely to go away given that the UK has not even initiated discussions with the European Union (EU) on post-Brexit arrangement, which could take up to two years. As a result, the BoE has revised down its growth outlook for the UK economy by a cumulative 2.5 percentage point up to 2019, QNB said.

This is the largest quarterly revision for nearly two decades, a sign of the magnitude of the shock that Brexit represents. In terms of employment, this means more than 250,000 jobs lost as a result of Brexit, according to the BoE projections.

What is more, the new revised numbers incorporate the sizeable monetary easing package just introduced.

“So what did the BoE do exactly? It decided to lower short-term interest rates by 25bps to 0.25%. It has also aimed at lowering long-term rates by restarting its QE programme with £60bn of UK government bond purchases.

“This is hoped to reduce the household and corporate debt service burden immediately since 50% of mortgages and 80% of bank loans to firms have floating rates, which are linked to short and long-term benchmark rates,” QNB said.

In addition, the BoE will buy £10bn of corporate bonds with the aim of reducing financing costs for companies and to encourage further issuance of corporate bonds as an alternative means of funding to bank loans.

Finally, the BoE is initiating a new scheme to provide banks with cheap funding to ensure that lower interest rates are transmitted to new loans to households and firms. QNB said the BoE has also signalled its intention to provide more stimulus later this year if its forecasts turn out as expected. But it has categorically ruled out the prospect of implementing negative interest rates in the UK.

This is probably influenced by the not-so-successful experience of negative rates in the euro area and, especially, Japan.

The governor of the BoE clearly stated his belief that the effective lower bound for interest rate is close to, but above, zero.

“Will the new easing package succeed in picking up the UK economy? The new measures could help reduce the borrowing costs for households and companies, but this is marginal. After all, the shock experienced by the UK economy is not financial but structural.

“Monetary policy cannot generate new trade deals for the UK, shed more clarity about what the UK will look like post-Brexit or compensate for potential lost productivity or slower labour force growth induced by Brexit. For that, other policymakers in the UK are required to act,” QNB said.

BOE