Turkey’s lira climbed more than 1% yesterday as its post-coup attempt recovery continued, while emerging market stocks tested nine-month highs as a G20 vow to boost global growth helped offset backsliding oil prices.

There was a broad-based rebound in Turkish markets, which sold off heavily last week following the failed coup and a subsequent crackdown by President Tayyip Erdogan.

This had unnerved investors and prompted ratings cuts by S&P Global and Fitch.

Alongside the rising lira, Turkish stocks rallied 2.5% to put them on course for their best day in more than a month, albeit a move likely to be small consolation to investors after their 13% plunge last week.

Murat Toprak, FX strategist at HSBC, said the stabilisation had been driven by two factors: “One is that, although the situation remains fragile, it is under control, there is no big destabilisation of Turkey.

Also, the global backdrop is relatively favourable.”

Supporters of Turkey’s ruling and main opposition parties rallied together in support of democracy at the weekend as deputy prime minister Mehmet Simsek also gave assurances that Turkey would adhere to the rule of law.

The yield premium paid by Turkish sovereign bonds over US Treasuries on the JP Morgan EMBI Global narrowed to 327 basis points (bps) in early trading, compared with a multi-month high of 342 bps hit last week.

Turkish five-year credit default swaps also narrowed to 271 bps according to data provider Markit, having blown out to five-month highs last week.

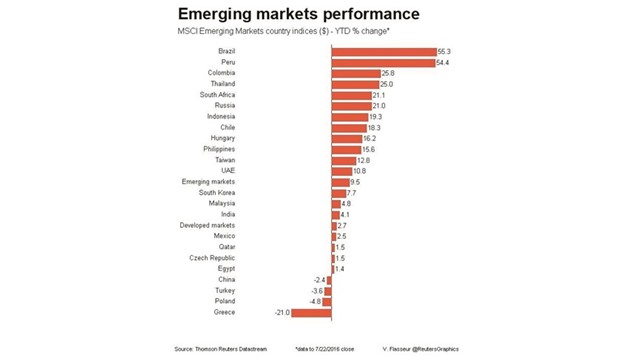

MSCI’s benchmark emerging equity index meanwhile was up 0.23%, nudging the nine-month high it hit last week.

The tick-up followed reassurances from G20 policymakers at the weekend that they would use “all policy tools” to boost global growth.

HSBC’s Toprak said loose, accommodative monetary policy globally remained the primary driver of financial markets.

“The key thing we are watching is if the European Central Bank, the Bank of England, and the Bank of Japan will deliver more — we are in an environment where the market expects more loosening from central banks,” Toprak said.

Polish stocks were among the biggest gainers in emerging Europe, up 1.3% to a one-month high, while Hungary shares rose 0.4% to an 8-1/2-year high.

Russian stocks rose 0.6% despite a fall in oil prices toward $45 a barrel.

South African shares jumped 1.2%.

Earlier there were gains in some Asian markets, with Chinese mainland shares up 0.18% and Indian stocks up around 1%.

In currencies, China’s yuan hovered near the six-year low it hit last week, as worries persisted over an economic slowdown, while the Malaysian ringgit hit a near 1-month trough amid the country’s 1MDB state fund scandal.

The Russian rouble also slipped 0.3%, as did the Israeli shekel ahead of a central bank meeting later where it is expected to leave interest rates unchanged for a 17th straight month.

Kenya’s central bank is also expected to hold rates at 10.5%, having made a surprise cut in May.

The Kenya shilling was a touch firmer. Yields on Morocco’s euro-denominated debt eased across the curve after the International Monetary Fund (IMF) granted Morocco a two-year $3.5bn credit line for structural reforms at the weekend.

Moroccan five-year credit default swaps also narrowed to 183 bps, according to Markit, the lowest level since August 2015.

EMERGING