Major Middle Eastern stock markets edged up yesterday although some shares with exposure to Turkey underperformed after the failed coup attempt there, and Saudi Arabia’s largest listed bank dropped after reporting second-quarter earnings.

The instability in Turkey is expected to have little financial impact on the Gulf because trade and investment ties are relatively minor.

Nevertheless, fund managers said the event made some investors more cautious about buying.

Qatar National Bank, which last month completed the acquisition of Turkey’s Finansbank, slipped 0.5%, pulling the Qatari stock index down 0.1%.

Dubai’s index rose 0.5% as builder Arabtec, the most heavily traded stock, jumped 4.7%.

On Thursday it said major shareholder Aabar Investments had agreed to give it a Dh400mn ($109mn) debt facility to help it weather “challenging” conditions in the industry.

Dubai Islamic Bank fell 0.9% after it said shares from its Dh3.2bn rights issue last month were now listed in the market’s electronic clearing system, facilitating trade.

Emaar Properties, which has real estate, retail and hospitality projects in Turkey, fell in early trade but closed flat.

Abu Dhabi’s index also climbed 0.5%, buoyed by First Gulf Bank, which added 2.0%.

But Abu Dhabi Islamic Bank sank 4.3% after it posted on Thursday a 1% rise in second-quarter net profit but warned it was restricting the amount of new credit it provided because of an increase in defaults across its business lines.

The Saudi Arabian index edged up 0.3% as dairy firm Almarai climbed 1.8% to Dh57.25 in its heaviest trade since February, after it said second-quarter net profit rose 18.6% year-on-year to 628.8mn riyals ($167.7mn), beating analysts’ average forecast of 530.3mn riyals.

However, the company said it was cautious about the future because of stiff competition due to Saudi Arabia’s economic slowdown, and the stock came well off its intra-day high of 59.25 riyals, failing a test of major technical resistance at the March and April peaks of 58.50 riyals.

National Commercial Bank fell 1.5% after its quarterly profit came in at 2.44bn riyals, at the low end of estimates; analysts had on average expected 2.54bn riyals.

Bahrain underperformed the Gulf, dropping 0.7%, after a court dissolved the main opposition group al-Wefaq and liquidated its funds, advancing a crackdown on the Gulf kingdom’s opposition.

Egypt edged up 0.2%, buoyed by real estate developers, with Palm Hills Development gaining 3.2%.

Elsewhere in the Gulf, the Kuwait index edged down 0.02 % to 5,390 points, the Oman index rose 0.2% to 5,872 points and the Bahrain index fell 0.7 % to 1,165 points.

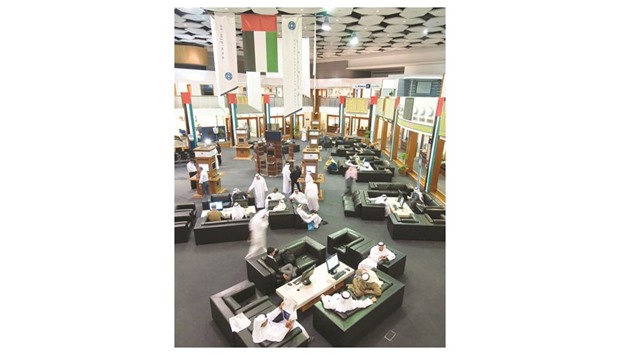

Investors move around at the Dubai Financial Market. Dubai’s index rose 0.5% as builder Arabtec, the most heavily traded stock, jumped 4.7%.