TECH

Technical analysis of the QSE index

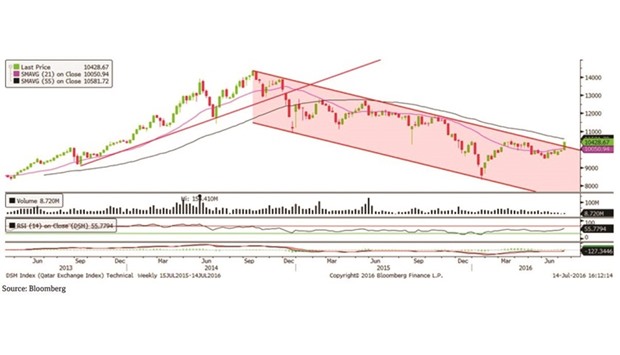

The QSE Index witnessed an uptick and gained around 4.70% to 10,428.67 vs the week before. The Index is approaching towards its strong weekly resistance of the 10,500 level. The Index managed to complete a strong bullish candlestick on the weekly chart. The RSI and the MACD lines are picking up pace, and has shown a positive divergence. Expected support and resistance levels remain at the 9,500 and 10,500 points, respectively. Only a move above or below these levels may decide the next direction of the index.

Definitions of key terms used in technical analysis

Candlestick chart — A candlestick chart is a price chart that displays the high, low, open, and close for a security. The ‘body’ of the chart is portion between the open and close price, while the high and low intraday movements form the ‘shadow’. The candlestick may represent any time frame. We use a one-day candlestick chart (every candlestick represents one trading day) in our analysis.

Doji candlestick pattern — A Doji candlestick is formed when a security’s open and close are practically equal. The pattern indicates indecisiveness, and based on preceding price actions and future confirmation, may indicate a bullish or bearish trend reversal.