China’s economy grew slightly faster than expected in the second quarter as a government spending spree and housing boom boosted industrial activity, but a slump in private investment growth is pointing to a loss of momentum later in the year.

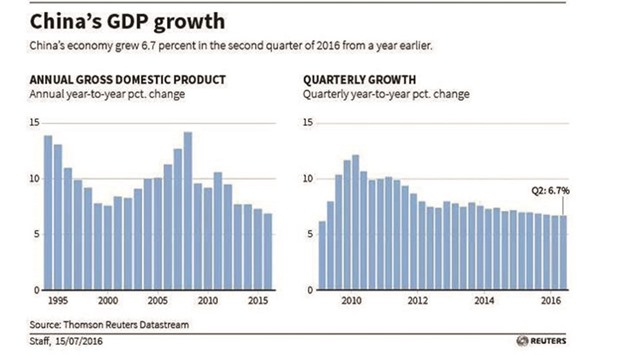

The world’s second-largest economy grew 6.7 % in the second quarter from a year earlier, steady from the first quarter but still the slowest pace since the global financial crisis, data showed yesterday.

Analysts had expected it to dip to 6.6%.

While fears of a hard landing have eased, investors worry a further slowdown in China and any major fallout from Brexit would leave the world more vulnerable to the risk of a global recession.

But signs of steadier headline growth in China may conceal an economy that is growing increasingly lopsided, as growth becomes ever more reliant on government spending and debt.

An anaemic private sector and signs of fatigue in the property market point to the increasing possibility the government may need to provide additional stimulus this year to hit its growth target of 6.5 to 7 %.

“We think GDP growth is likely to slow in Q3 and may rebound in Q4 driven by post-flood reconstruction activity.

But the rebound will not last long,” said Nomura economist Wendy Chen.

Economists at ANZ also believe the second-quarter’s growth rate is unlikely to be sustained, pointing to cracks emerging in the property sector, whose recent revival has spurred demand for everything from cement and steel to appliances and furniture.

“Property investment grew 6.1% in the first six months, lower than 7% in January-May. Therefore, the property-led recovery has ended,” ANZ said in a research note.

Indeed, Zoomlion Heavy Industry, a major Chinese construction equipment maker, warned investors yesterday that its first-half net loss would more than double due to weak demand for construction machinery.

There were some bright spots in yesterday’s data, as consumption accounted for a greater amount of growth and retail sales and industrial output beat expectations. But in a sign that Beijing has doubled down on its stimulus efforts, first half bank lending hit a record and government spending jumped 20% in June. At the same time, growth in investment by private firms fell to a record low in the first half, as businesses retrench in the face of the sluggish economic outlook and weak exports.

This slowdown has alarmed investors and policymakers alike, as the private sector accounts for over 60% of China’s total investment and 80% of its jobs.

“While there was a big pick-up in retail sales, the slowdown in fixed-asset investment is a worry.

Given the slide in fixed-asset investment growth, I’m inclined to keep my forecast of slowing growth over the course of the year,” said Tim Condon, chief economist for Asia at ING in Singapore. Policymakers have said the economy remains largely steady, but with private investment shrinking the government has had to do more of the heavy lifting, adding to worries about reforming the bloated and inefficient state sector.

Chinese leaders are trying to support growth to prevent widespread job losses and debt defaults, but they are also facing pressure to push through painful structural reforms such as reductions in industrial overcapacity that would put the economy on a more balanced and sustainable footing.

While officials insist the risks from higher debt levels are manageable, some analysts believe a massive debt and bank restructuring is becoming increasingly likely. JPMorgan chief China economist Zhu Haibin expects continued government fiscal support in the second half of the year, and another interest rate cut by the central bank, likely in the fourth quarter.

“We expect third quarter sequential growth will probably come down” from the second quarter’s 1.8%, he said.

Still, while better second-quarter and June data have dispelled forecasts of doom from China sceptics for now, the country’s long-standing problems have not gone away, PNC senior economist Bill Adams said.

“Growth is disquietingly dependent on the housing sector, and the country’s financial system will likely need to restructure bad debts created during the post-crisis credit boom eventually,” Adams wrote in a note.

Without progress on such looming challenges, China’s long-term diagnosis isn’t good, according to economist Paul Krugman.

“China, if you look at the macroeconomic picture, looks a lot like Japan in the late 1980s. A Chinese bubble burst is still my forecast but it was my forecast the year before and the year before last.

But I still believe one of these days it will happen,” Krugman said in Singapore on Thursday.

“An unsustainable situation can go on for longer than you can imagine and ends more quickly than you can imagine and I still think that’s the story for China.”

Meanwhile, non-performing loans of China’s commercial banking sector rose to 1.81% of total lending at the end of the second quarter, the highest since the global financial crisis in 2009, the country’s top bank regulator said.

Shang Fulin, chairman of the China Banking Regulatory Commission (CBRC), urged banks to elevate risk management to a “more prominent” place and take measures to “rein in the rapid rise of non-performance loans” at the regulator’s half-year meeting, according to a statement on the CBRC’s website.

At the end of March, non-performing loans (NPLs) were 1.75% of commercial banks’ lending. The build-up of troubled credit at Chinese lenders has so far shown no sign of abating as the world’s second largest economy continues to battle problems such as high leverage of its corporate sector and excess industrial capacity.

Shang also told banks to increase their ability to recover and write-off troubled assets, and said China will expand its pilot scheme of NPL securitization to include more financial institutions. He did not disclose the total volume of NPLs at the end of June.

Shang also urged China’s asset management companies, which handle distressed debt from banks, to increase their ability to offload batches of non-performing assets more efficiently.

Outstanding bank loans grew to 106.69tn yuan ($15.97tn) at end-June, up 13% from a year earlier, he added.

The loan-provisioning ratio for banks stood at 161.3% at the end of June, while the capital adequacy ratio for major banks amounted to 13.2%, Shang said, without providing details.

GOVT