Despite the rally in oil prices since the start of the year, a majority of senior airline executives expect carriers’ operating costs to “fall further or remain unchanged” over the next 12 months, IATA has said in a report.

In its July survey in relation to airline business confidence index, airline CFOs and heads of cargo said this was due to hedging practices in the industry, but also in part to the partial recovery seen in many currencies against the dollar over recent months (which matters because oil and jet fuel are typically priced in US dollars).

That said, in a reflection of strong competition in the passenger market, airline CFOs expect yields to fall by slightly more than input costs over the year ahead.

On the freight side, ongoing increases in freight capacity are also expected to continue to weigh heavily on freight yields over the year ahead.

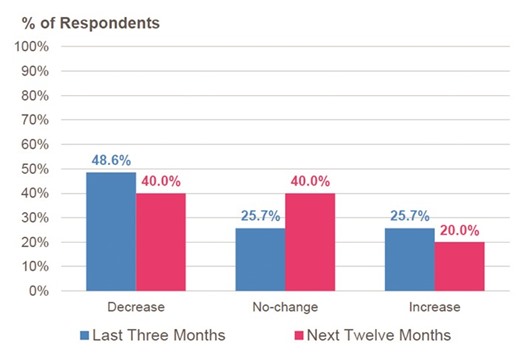

Just under half of respondents reported an annual decrease in operating costs in Q2, 2016, which is consistent with wider developments in the crude oil market.

The price of jet fuel, which accounts for around one-third of total industry costs, was approximately 27% lower in Q2, 2016 compared to the same period a year ago.

Expectations for growth over the coming 12 months remain positive for both passenger and cargo businesses.

But while the latter stabilised in July’s survey, the outlook for cargo continues to be held back by structural headwinds, IATA survey said.

65% of survey respondents reported a year-on-year decrease in passenger yields in Q2, 2016 – the second survey in a row in which a greater proportion of respondents reported a decrease in passenger yields than a decrease in input costs.

Respondents expect further yield declines over the coming 12 months.

In short, headwinds to further gains in profits are expected to persist.

Ongoing strong capacity growth continues to put acute pressure on cargo yields.

Almost two-thirds of the survey respondents reported year-on-year decreases in cargo yields in Q2, 2016.

The weighted average score for yields over the past three months dropped to its lowest level since the second half of 2009.

The results of the July survey show that cargo heads do not expect any respite for yields over the next 12 months; a combined 90% of respondents expect cargo yields to remain unchanged or to fall further in the year ahead.

In a reflection of the current financial health of the industry, airlines have been adding to their workforces: 40% of survey respondents reported an increase in year-on-year employment levels in Q2, 2016.

The weighted average score for employment activity over the past three months bounced back in the July survey and has now been above the 50-mark for six consecutive quarters.

The latest IATA survey results remain consistent with airlines expecting to add more staff over the next 12 months, with the weighted average score remaining above the 50-mark.

That said, the weighted average score dropped back compared to the previous survey results, driven by a smaller proportion of respondents explicitly expecting to increase employment levels over the year ahead (34% vs. 42% before), IATA said.

Business / Business

Airlines’ operating costs to ‘fall further or remain unchanged’ for one year: IATA

.