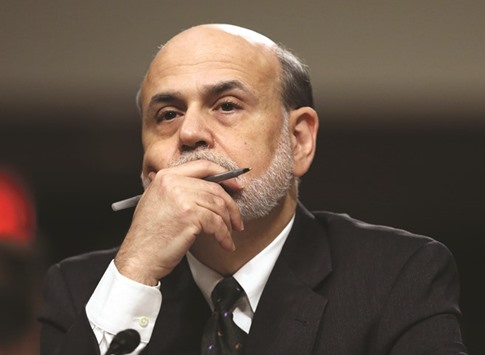

Ben S Bernanke,who met Japanese leaders in Tokyo this week, had floated the idea of perpetual bonds during earlier discussions in Washington with one of Prime Minister Shinzo Abe’s key advisers.

Etsuro Honda, who has emerged as a matchmaker for Abe in corralling foreign economic experts to offer policy guidance, said that during an hour-long discussion with Bernanke in April the former Federal Reserve chief warned there was a risk Japan at any time could return to deflation. He noted that helicopter money - in which the government issues non-marketable perpetual bonds with no maturity date and the Bank of Japan directly buys them – could work as the strongest tool to overcome deflation, according to Honda. Bernanke noted it was an option, he said.

Though Honda said he thought Japan was already engaged in a strategy that involved helicopter money, he wanted to convey the idea to Abe and asked Bernanke to meet with the premier in Japan. While this didn’t happen in the spring, Bernanke joined central bank chief Haruhiko Kuroda over lunch this Monday and on Tuesday he attended a gathering with Abe and key officials, including Koichi Hamada, another influential economic adviser.

Bernanke at the Tuesday meeting said Japan should carry on with Abenomics policies by supplementing monetary policy with fiscal stimulus, according to Hamada. Bernanke told Abe that the BoJ still has instruments to further ease monetary policy, said Yoshihide Suga, Japan’s top government spokesman. The central bank didn’t reveal what Kuroda and Bernanke discussed.

Hamada said helicopter money wasn’t mentioned with Bernanke on Tuesday. Suga denied an earlier report that officials around Abe were considering helicopter money as a policy option. Bond traders, stock investors and economists have been mulling the possible implications of Bernanke’s visit and the next steps to come in Abenomics. Amid intense speculation about the chances of helicopter money, and the certainty of further fiscal stimulus ordered by the prime minister, Japanese shares have rallied for four consecutive days while the yen has weakened.

The Japanese currency weakened Thursday, trading at 105.85 per dollar as of 7:10pm Tokyo time, down 1.3% on the day.

“There’s a strong allergy to so-called helicopter money in Japan, though the definition of the word differs from person to person,” Honda said in an interview on Wednesday. “While looking at the BOJ’s bond purchases and fiscal policy as a package, which I see as a kind of helicopter money, it would be beneficial if the prime minister understands that there is a global leading scholar clearly advocating helicopter money,” said Honda, who was speaking by telephone from Switzerland, where he is serving as Japan’s ambassador.

Bernanke is now a fellow-in-residence at the Brookings Institution in Washington. A Brookings communications officer last week said Bernanke wouldn’t be available for an interview on his discussions in Japan this week. Honda, 61, said he told Abe about Bernanke’s views after his April meeting.

“I told him now is the time for Japan to expand fiscal spending and at the same time, additional monetary easing should be taken,” Honda said. “I told him it is necessary to strengthen the effects of Abenomics” through such a strategy.

Japan has a long history of tapping foreign advisers. Honda, though, has taken the practice to a new level, bringing prominent overseas economists into the inner circle of Japanese policy making. The objective: adding star power to the weight of his own views on pivotal economic decisions.

Honda is a former Finance Ministry civil servant who has known Abe since they met at a wedding reception more than three decades ago. He was among the key people who persuaded the premier to adopt his programme of reflation in 2013.

In 2014, Honda set up a meeting for Abe with Nobel laureate Paul Krugman, who successfully made the case for delaying a sales-tax increase. When the same issue confronted the Abe administration this spring, Joseph Stiglitz, another Nobel recipient, was brought in. A visit with Krugman followed.

Speaking to reporters in Singapore yesterday, Krugman said that from a strictly economic perspective, helicopter money “adds nothing.” But it could have merits from a political economy point of view, he said.

Adair Turner, a former head of Britain’s financial regulator, has said it would be useful to make clear to the Japanese people that it’s not necessary that the public debt all be repaid.

“I do not believe that there is any credible scenario in which Japanese government debt can be repaid in the normal sense of the word repay,” according to Turner. “It would therefore be useful to make clear to the Japanese people that the public debt does not all have to be repaid, since some of it can be permanently monetized by the Bank of Japan.”

Yuji Shimanaka, an economist at Mitsubishi UFJ Morgan Stanley, said Honda has proven to be very influential in shaping Abe’s economic policies. “We will have to pay close attention to his comments to predict the course of Abenomics,” Shimanaka said.

Bernanke: Warns of deflation risk for Japan.