Qatar’s economy has “weathered low oil prices” due to strong macroeconomic fundamentals including a low fiscal breakeven price, the accumulation of significant savings from the past and low levels of public debt, QNB has said in its ‘Qatar Economic Insight’.

QNB expects real GDP growth to accelerate from 3.3% in 2016 to 3.9% in 2017 and 4.2% in 2018 with the ramp up in investment spending and initial gas production from the Barzan Gas Project.

Qatar’s inflation is expected to rise to 3.2% in 2016 and 3.4% in 2017 in line with the pick-up in global inflation, before moderating slightly to 3% in 2018.

International inflation is expected to rise on stronger food and oil prices while population growth should support domestic inflation.

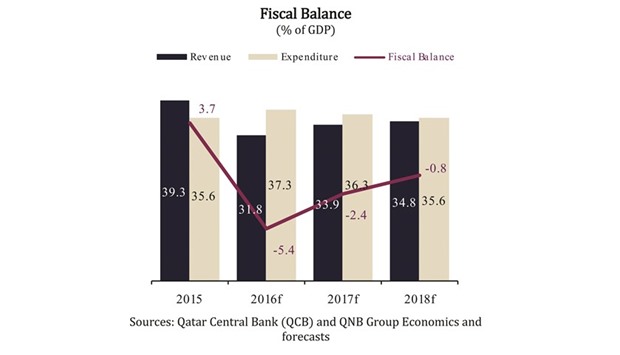

Lower hydrocarbon revenue and continued capital spending by the government are expected to result in modest deficits in 2016 and 2017, but the rebound in oil prices should gradually bring the government back to near balance by 2018.

Revenue is expected to decline in 2016 due to the weakness in oil prices and slower non-hydrocarbon growth, but should pick up over the medium-term due to the introduction of a 5% value-added tax in 2018.

The government is expected to continue its investment spending programme while rationalising current spending, leading to a modest decline in expenditure as share of GDP from 2016 to 2018.

The country’s credit growth is projected to reach 11.0% in 2016 and 9% in each of 2017 and 2018, supported by project lending and higher consumption from the rising population.

The loan-to-deposit ratio is expected to stabilise at around 120%; NPLs are forecast to remain low over the medium term as asset quality is expected to be backed by the strong macroeconomic environment.

“The outlook for banking is positive with low provisioning requirements and efficient cost bases supporting bank profitability,” QNB said. Oil prices are expected to recover over the medium term; averaging $41/barrel in 2016, before rising gradually to $51/b in 2017 and $56/b in 2018 as declining US oil production and steady demand growth are expected to reduce excess supply, QNB said.

Business / Eco./Bus. News

Qatar’s economy ‘weathers’ low oil prices on strong macroeconomic fundamentals: QNB

ECONOMY