Hedge funds and other money managers are betting diesel and heating oil will take over from gasoline as the main driver of US refinery profitability in the second half of the year.

For the past 18 months, refiners have been rewarded for maximising output of gasoline and minimising production of diesel, but that could all be about to change.

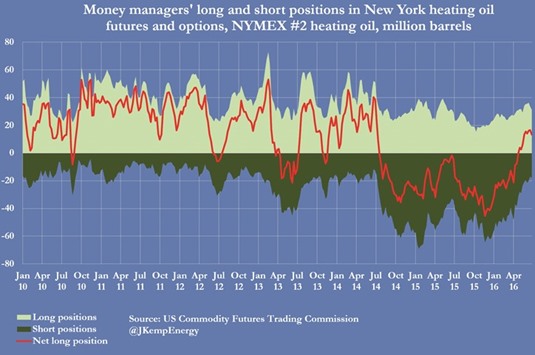

By the middle of June, hedge funds had accumulated the largest net long position in heating oil futures and options since oil prices began to slump in July 2014.

At the same time, hedge funds were running one of the smallest net long positions in gasoline contracts in the past decade.

The most recent data published by the US Commodity Futures Trading Commission shows some profit-taking on these positions in the week to June 28.

But the strongly bullish position on heating oil and bearish position on gasoline remains fundamentally intact for the time being.

At the start of the year, hedge funds were bearish towards heating oil and bullish on gasoline, but the position began to switch from March onwards.

The switch in hedge fund positions has coincided with a marked strengthening in the refining margins for diesel and weakening of those for gasoline.

The gross refining margin for diesel for October is now 35 cents per gallon compared with just 23 cents per gallon for gasoline.

Despite record consumption of gasoline, refiners have struggled to work down the excess stockpiles that built up in January and February.

Gasoline stocks remain close to the highest level for a decade even after adjusting for current record rate of demand.

Gasoline stocks are currently equal to 24.6 days worth of consumption, down from 29.2 days at the end of January, but still well above the 22.7 days at this point last year and the 10-year average of 22.9 days. By contrast, the enormous overhang of diesel stocks that built up at the start of the year has been steadily reduced over the last two months.

Diesel stocks have dropped from almost 50 days worth of consumption at the turn of the year to 39.3 days although they are still well above the 34.5 days this time last year and the 10-year average of 31.9 days.

During the summer driving season, gasoline stocks normally fall while diesel stocks rise, as refiners run hard to produce motor fuel and find themselves with too much distillate as a by-product.

But this year gasoline stocks show little signs of reducing while diesel stocks are exhibiting an unusual seasonal decline.

Counter-seasonal stock movements suggest the US market is on course to have surplus gasoline and not enough distillate once the summer driving season is over.

Margins are adjusting accordingly.

Hedge funds and futures prices are also anticipating stronger demand for diesel during the winter of 2016/17 after unusually weak demand over the winter of 2015/16.

El Nino, which contributed to an unusually warm winter in parts of North America during 2015/16, is now giving way to La Nina.

The unusually warm winter temperatures experienced last winter are unlikely to be repeated in the coming winter which should increase consumption of heating oil.

Diesel demand should also get a boost from an eventual recovery in the freight market, provided the US

and global economies manage to avoid recession.

Freight remains sluggish, but US manufacturers, distributors and retailers do at last seem to be starting to get a grip on excess inventories, which could herald an eventual improvement.

The realignment of gasoline and diesel margins seems to have a solid grounding in supply-demand-stocks fundamentals.

The big problem is the large concentration of hedge fund positions, which makes the market vulnerable if they all attempt to unwind at the same time.

With hedge funds already so bearish on gasoline and bullish on heating oil, and margins already having moved significantly, the risk now is that margins will recoil as the funds try to take some profits.

Profit-taking already seems to have started in the final week of June but could still have some way to run.

* John Kemp is a Reuters market analyst. The views expressed are his own.