Short sellers are targeting Turkish Airlines as it presses on with expanding capacity while the country’s tourism industry withers.

As much as 13.8% of the company’s shares that are available for trading are out on loan to short sellers betting they will fall in value, according to Markit Ltd. That’s the highest on record for Turkish Airlines, making it the most-shorted developing-nation carrier after Panama’s Copa Holdings, Bloomberg calculations based on the data show.

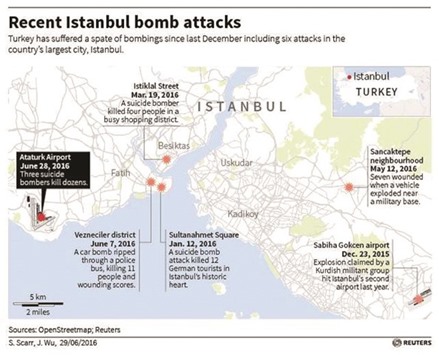

Tourist arrivals to Turkey fell almost 35% in May from a year earlier, the fastest drop in at least a decade and followed a 28% decline in April. A diplomatic row with Russia after one of its warplanes was shot down for straying into Turkish airspace deterred some of its most enthusiastic holidaymakers, causing much of the slowdown. Terrorist attacks in Turkish cities have also kept travellers away and the airline in May reported its worst quarterly loss in more than 16 years.

“You can feel the negative sentiment when you look at the news,” Amine Wafy, an analyst at Renaissance Capital in Dubai said by phone. “Current tourism, traffic and passengers stats in Turkey do not support a bullish view on the name,” he said. The buy rating on the stock is currently under review at Renaissance.

Short traders seek to profit by borrowing and selling shares they expect to fall in value only to buy them back at a lower price and return them to the original owners. Bets against Turkish Airlines stock peaked at the end of May and have stayed around this level, the highest in at least a decade, the Markit data shows.

Turkish Airlines declined to comment on the short selling data when contacted by Bloomberg on Friday.

While Turkish Airlines’ passenger numbers rose 7.8% this year to the end of May, seat occupancy declined by 3.6 percentage points as its fleet and number of destinations expanded, according to company data. Turkish Airlines was targeting 18% passenger growth in 2016 as recently as January and still plans to increase capacity by 20% in the second half of the year.

Turkish Airlines chief executive officer Temel Kotil said in an interview with Bloomberg that growth in transit passengers will help offset declining tourist demand. The company still expects to post record revenue of $12.2bn this year, he said.

“The number of passengers is solid,” Kotil said last Thursday. “Our global market share depends on transit.” He also said the plunge in tourist arrivals from Russia has had a minimal impact on the business because that market relies on charter aircraft.

Turkish Airlines is also unlikely to suffer in the market convulsions triggered by the UK’s vote to leave the European Union because of minimal exposure to the country, Goldman Sachs said in a note published on Monday.

Some investors are not convinced. Shares of Turkish Airlines, as Turk Hava Yollari AO is known, have declined 18% this year even as the country’s stock market has added 6.6%. Analysts at Garanti Securities, an Istanbul-based brokerage, have cut earnings estimates for Turkish aviation companies including Turkish Airlines, citing concerns over demand, currency swings and the risk of “irrational price wars” from extended capacity.

The stock is very liquid, which “makes it easy to short,” said Burak Isyar, an analyst at Istanbul-based Burgan Yatirim Menkul Degerler, who expects operational weakness to also be reflected in the company’s second-quarter earnings.

Still, Isyar and RenCap’s Wafy are both bullish on the company’s prospects in the longer term, with Wafy citing Istanbul’s new airport coming online at the end of 2018 and Turkish Airlines’ transit traffic as positive for the company’s prospects.

For now the outlook seems less rosy, said Michel Danechi, who helps oversee $1.5bn in emerging-market assets as Duet Asset Management in London.

“The company’s plans are unrealistic given geopolitical risks,” he said. Danechi declined to disclose his positions in Turkish stocks, citing compliance concerns, and said Kotil’s upbeat comments did not change his view. “They planned for massive growth, which simply has not happened.”

.