Zinc continues to shine amid the general gloom pervading the base metals complex.

On the London Metal Exchange (LME) benchmark three-month zinc has eased back from the near one-year high of $2,105.50 per tonne hit earlier this month.

But at a current $1,983, zinc is still showing year-to-date gains of over 26%, by some margin the best performance of the base metals pack.

Investors have been drawn into the market by an enticing narrative of closing mines and a tightening raw materials supply chain.

Just how quickly this tightness moves into the refined metal part of the chain is dependent on two “known unknowns”: the ability of Chinese producers to lift output and the size of off-market metal stocks.

Friday morning’s LME stocks report, showing the warranting of 19,750 tonnes of zinc at New Orleans, is a timely reminder that there may be much more sitting out of the statistical light in the US

port. But still higher prices are collectively viewed as a matter of “when”, not “if”, and the scale of bulls’ ambitions is clear to see in the LME options market.

Market open interest shows an extremely strong bias towards call options, which confer the right to buy, over put options, which confer the right to sell.

Open interest on calls totals 42,582 lots through January 2018, while open interest on puts stands at just 26,200 lots over the same period.

It’s worth remembering that these official exchange figures may not capture the full scale of positioning since there may be more sitting in the twilight of the over-the-counter market.

The split between calls and puts is less stark over the next three months but there is still significant open interest in upside calls lying just out of the money.

All three months, July, August and September, were valued at just under $2,000 per tonne as of Thursday’s close.

As such, there is a total 16,394 lots, or 409,850 tonnes, of currently out-of-the-money call options stretching up to $2,500 per tonne over the coming period.

Positions are clustered on “big-number” strikes such as $2,000 (2,257 lots), $2,100 (3,679 lots), $2,150 (1,989 lots) and $2,200 (2,797 lots).

Depending on the levels of hedging by option market-makers, these calls could act as upside magnets if the price starts moving up through them, forcing options sellers to “delta-hedge” their exposure in the underlying futures market.

But it’s further down the forward curve that things become even more interesting.

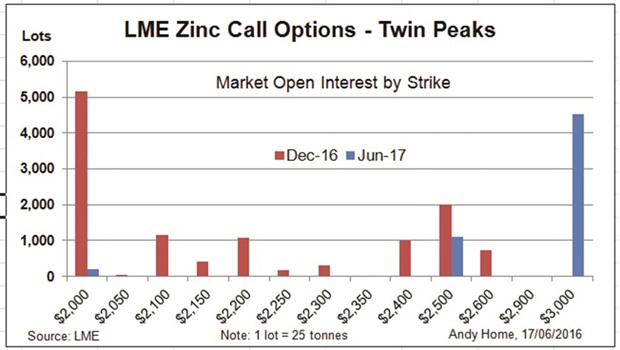

There are two stand-out months in terms of call option positioning, December 2016 and June 2017.

Both have seen large new call positions opened in recent weeks.

The single biggest concentration of call options on December, valued at $1,992.75 per tonne at Thursday’s close, is on the $2,000 strike with 5,160 lots.

There is also sizeable open interest on the $2,400 and $2,500 strikes with open interest of 1,000 and 2,008 lots respectively.

In June 2017, meanwhile, call option open interest is largely sitting on just two strikes, $2,500 (1,100 lots) and $3,000 (4,512 lots).

one is equivalent to 112,800 tonnes and all the more remarkable because the rest of the June 2017 options open interest map is largely empty.

Total put option open interest is only just over 1,000 lots.

It’s a big statement of bull ambitions. Is $3,000 zinc feasible? Yes, according to analysts such as Leon Westgate at ICBC Standard Bank.

Westgate argued in a March research note (“Zinc: The Revenant”) that “refined deficits of 550,000 tonnes in 2016 and 660,000 tonnes in 2017, representing nearly 5% of refined consumption, will rapidly destock the zinc market and will provide the foundations for zinc to reach record high prices in the next 24 months.”

The record high for LME three-month zinc was $4,580 all the way back in December 2006.

The problem, as ever with this market, is one of timing.

The flow of zinc concentrates into China fell by 17% over the first four months of this year, seemingly attesting to a rapidly tightening raw materials market.

Yet China’s refined zinc production was still up by 0.5% in the January-May period, suggesting either concentrate stocks were drawn down or domestic miners picked up the slack or both.

Just how much flex there is in China’s small-scale mining sector is highly uncertain given the paucity and unreliability of historic data.

Another uncertainty is how long Glencore will hold its 500,000 tonnes of annualised zinc mine cuts, although as a major producer it has no obvious incentive to kill off any nascent price rally by reversing them too early.

And then there are those New Orleans stocks.

Everyone assumes there is much more metal sitting in off-market sheds in the US port.

Each and any of these factors could derail the zinc bull narrative or at the very least push back the timing of any price surge.

*Andy Home is a columnist for Reuters. The views expressed are those of the author.