It’s been a tough week for copper bulls. The price of benchmark three-month delivery copper on the London Metal Exchange (LME) has slumped almost $250 to a current $4,498 per tonne, the lowest level since February.

Copper is now challenging out-of-favour lead as the worst performing base metal so far this year.

This is not a story of macro headwinds.

Zinc, for example, hit a fresh one-year high above $2,100 per tonne on Thursday.

Rather, it is all about the surge in LME copper stocks, a total 65,550 tonnes hitting the LME warehouse system in the first four days of the week.

Headline registered inventory hit a four-month high of 213,225 tonnes as of Thursday’s daily report.

At first glance this might appear to be no more than an acceleration of the recent rebalancing of global inventory away from a sated Chinese to a depleted LME market.

But the timing and scale of the inflows suggest that there was more going on than just fundamentals. This week’s events bear all the hallmarks of a battle between two of the market’s bigger players for control of the London copper spreads.

This week’s inflow of copper was largely concentrated on just four LME locations: Singapore (39,650 tonnes), Taiwan (3,850 tonnes) and the two South Korean locations of Busan (11,450 tonnes) and Gwangyang (6,800 tonnes).

All four have seen sporadic arrivals of copper since the start of April, roughly corresponding to export flows out of China over the first few months of this year.

Chinese exports hit a near two-year high of 32,400 tonnes in April, bringing the year-to-date tally to 75,500 tonnes.

How much was exported in May will only be known when the full trade figures are released later this month.

The consensus is that outbound flows will have remained robust, given high bonded stocks at Chinese ports and correspondingly weak physical market premiums.

The small handful of Chinese smelters permissioned to export copper without paying the export tax will almost certainly have been enticed to continue shipping material by the combination of the cash premium on the LME and delivery incentives offered by LME warehouse operators.

But when large tonnages of any metal hit the LME warehousing system over a limited timeframe, it’s a tell-tale sign that the material hasn’t just physically arrived at the port the prior day.

More likely is that it was already sitting in situ in off-market storage or was gradually accumulated before being placed on warrant, at which stage it “shows up” in the LME’s stock reports.

Singapore, for example, saw 18,350 tonnes of warranting activity in Tuesday’s stocks report.

The previous highest daily inflow since copper arrivals began in early April was just 4,800 tonnes.

All the evidence suggests this week’s “arrivals” were coordinated and executed to have maximum impact on the market.

To understand why someone may have wanted to flood the London market with copper, you need look no further than the LME’s market positioning reports.

What the exchange terms a dominant long position emerged on the copper market last week.

This player controlled 50-80% of all LME open stocks, excluding metal earmarked for physical load-out, and had bulked this up with cash positions to the point that its overall position represented in excess of 90% of all available stocks.

That position was being rolled forward daily, forcing shorts to pay the backwardation price as they too rolled their positions.

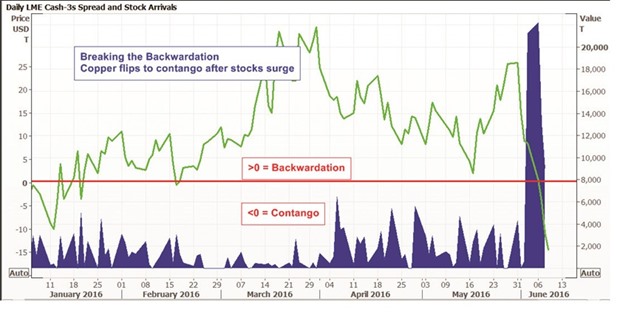

The cash premium over three-month metal, the backwardation, had flexed out as wide as $27.75 per tonne the previous week as the long tightened its grip on the London market’s nearby date structure.

Someone, it seems, was not prepared to pay the roll price and decided to deliver physical metal against their position.

And they did so in a way to generate the maximum bang for their buck.

It seems to have worked.

That cash premium has evaporated.

As of Thursday’s close, the cash-to-three-months spread was valued at $15 per tonne contango.

The ripple effects have spread down the curve, LME broker Marex Spectron noting that the July-December spread eased $10 to $35 per tonne contango over the course of Thursday.

The latest positioning reports, denoting the state of play as of Wednesday’s close, show the dominant long still holding 50-80 % of stocks but with no equivalent cash position.

The war may continue but it’s clear who won this particular battle of the LME copper spreads.

LME stocks report showed no copper arrivals at all, suggesting that this week’s flood has now abated.

Will more arrive? It seems likely that there will be a resumption of the sporadic inflows seen earlier as long as Chinese smelters favour the LME over the domestic market.

Set against this outbound flow, however, is a continued much stronger import flow.

Andy Home is a columnist for Reuters. The views expressed are those of the author.