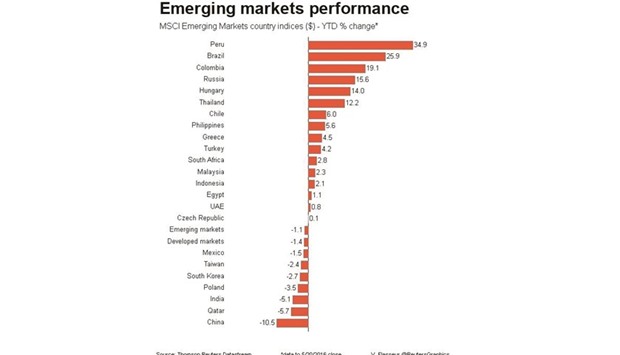

Hungarian stocks shone yesterday as the country’s return to investment grade after three years in ‘junk’ territory helped to lift emerging markets after four straight weeks of losses.

A dip in the dollar allowed a general drift higher for EM currencies and Greek markets cheered hopes of a new aid deal, though there was also plenty of uncertainty elsewhere to keep optimism in check.

The instalment of a new Turkish Prime Minister, Binali Yildirim, who has close ties to President Tayyip Erdogan, weighed on the lira.

Economists also suspected that details on Brazil’s budget due today might temper the surge in markets there.

Hungary’s shares were up 0.8% and the best performers in eastern Europe after Fitch made it the first emerging market since Romania with S&P two years ago to graduate to the so-called ‘investment grade’ level.

Fitch cited Hungary’s declining debt levels and lower vulnerabilities for the move and Economy Minister Mihaly Varga said the country could see its borrowing bill drop by around 60bn forints ($214mn) if another agency followed suit.

The forint was looking groggy, though, roughly 0.5% lower against both the euro and the dollar.

UniCredit EM FX Strategist Kiran Kowshik said one potential reason was that it may pave the way for more rate cuts.”We are quite surprised you have only seen a limited lift in the forint,” Kowshik said.”It is also possible that with the event risks on the horizon, such as the Brexit vote for example, it might not be the right time to be playing these bonds,” Kowshik added, referring to Britain’s June 23 referendum on whether to leave the European Union.

Turkey’s lira sagged to 2.9871 to the dollar, partly on political worries.

Veteran transport minister Yildirim, chosen at a special congress on Sunday as leader of the ruling AK Party, made clear his priority as prime minister would be a new constitution centred on a strong executive presidency, as sought by Erdogan.”Erdogan is a man of purpose, a man of the people, a tireless defender of the great Turkey,” he said.”We have said with pride, heads held high, we are comrades of Erdogan.

Your passion is our passion, your cause our cause, your path our path.” The prospect of another rate cut when the central bank meets this week also pressured the lira.”We are expecting a 50 basis point rate cut in the interbank rate,” said Barclays emerging market economist Aropp Chatterjee.”We think that the change in the government, alongside the change in the central bank, which is trying to bring down lending rates, will lead the lira toward 320-325 towards year-end.”

Elsewhere, Russian sources said the country was selling a 10-year eurobond through VTB Capital after European banks were put off by sanctions, while Kenya and Israel were expected to keep their respective interest rates on hold.

Asian currencies rose overnight on the back of the softer dollar as traders waited to see whether US data and comments from Federal Reserve officials this week would feed last week’s resurgence in June or July rate hike bets.

EME