Australia’s securities regulator is set to publish a proposal next month to allow financial technology companies to start operating without a full licence, one of the agency’s top executives said on Wednesday.

The potential new rules would create a controlled environment, or “sandbox”, to allow start-ups to launch in the market with restricted authorisation before being granted a full licence, Cathie Armour, a commissioner at the Australian Securities and Investment Commission (ASIC), told the Reuters Financial Regulation Summit.

“We are going to issue a public consultation on some potential adjustments to the regulatory framework which might be of particular help to fintech businesses. They’ll obviously have regulations imposed on them but, potentially, for a limited period of time, some aspects of regulation will not be imposed just to allow experimentation.”

ASIC is exploring how it could use waivers and no-action notices to implement the sandbox framework, which ASIC hopes to get up and running by the end of the year, said Armour.

ASIC has been drafting the proposal in consultation with fintech experts, including Alex Scandurra, CEO of Sydney fintech hub Stone & Chalk.

“We are exploring the opportunity to create a sandbox that allows start-ups to validate, rapidly prototype and engage with various customer groups prior to having to engage in a formal licensing process,” Scandurra told the summit.

Many fintech business models do not easily fit into the existing license-based financial regulatory framework operated in many countries, making it tough for start-ups to become established and sparking calls for regulators to provide more clarity on the rules for fintech services.

The UK Financial Conduct Authority (FCA) said last year it would launch a regulatory “sandbox” for fintech firms to create a safe space in which authorised firms can experiment to validate their business models.

Under that programme, which opened to applicants last week, fintech firms which meet certain FCA criteria will be granted “restricted authorisation” by the FCA to test their ideas without fear of prosecution if they break the FCA’s rules.

“We’ve looked at what the FCA’s proposal is and we’re looking to do something much more far-reaching,” said Scandurra.

Australia wants to develop Sydney as a fintech hub similar to Silicon Valley and has announced tax breaks for early-stage investments as well as a visa scheme for entrepreneurs to attract talent.

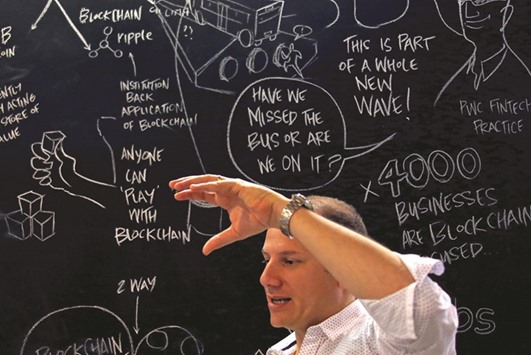

Alex Scandurra, CEO of Sydney fintech hub Stone & Chalk, talks in front of a drawing board located in the company’s offices in central Sydney.