European stock markets fell yesterday on disappointing Chinese data, but news billionaire investor Warren Buffett has taken a $1bn bite into Apple helped push Wall Street higher.

London stocks shed 0.4%, Madrid lost 1.1% and Paris dropped 0.6%, as investors fretted over fresh evidence of China’s economic slowdown.

Trade was subdued however owing to a holiday closure in Frankfurt.

“It was Monday Blues in European markets after weak economic data from China released over the weekend added to investor woes brought about by Wall Street falling to its lowest in a month,” said CMC Markets analyst Jasper Lawler.

“The Whit Monday holiday has dampened trading volumes.”

“The FTSE 100’s rollercoaster ride continues, starting the week with a quick dive, unwinding an impressive rally Friday afternoon,” added Lee Wild, head of equity strategy at online stockbroker Interactive Investor.

“Data out of China over the weekend disappointed at every level – industrial production, retail

sales and investment growth.”

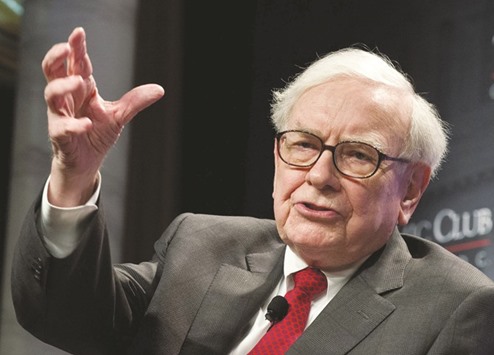

Wall Street opened on the upside yesterday after billionaire investor Warren Buffett took a bite of tech giant Apple, with the Dow Jones Industrial Average rising 0.2%.

The $1bn stake in Apple was revealed in a regulatory filing by Buffett’s holding company Berkshire Hathaway after Apple shares skidded last week to their lowest level in two years.

Buffett’s entry comes weeks after another billionaire, Carl Icahn, announced he had sold all his Apple holdings after an extended campaign to get the company to deliver more value to shareholders.

Billionaire Warren Buffett, CEO and chairman of investment company Berkshire Hathaway, speaking at the Economic Club of Washington. Buffett has taken a $1bn stake in Apple, whose stock has been in an extended slump.