“The oil market has gone from nearing storage saturation to being in deficit much earlier than we expected,” Goldman Sachs analysts said in a research note published on Sunday.

“The physical rebalancing of the oil market has finally started,” according to the bank, which has been among the most bearish on the outlook for surpluses and prices.

Goldman raised its near-term forecasts for WTI by around $10 per barrel in both the second and third quarters of 2016 (“Fundamental volatility creates uncertain path for oil rebalancing”, Goldman Sachs, May 15).

In many ways the bank is playing catch up, because WTI has already risen $20, almost 80%, from its low on February 11.

Goldman is exceptionally well connected with the hedge fund community and its forecasts are famous for influencing oil prices, at least in the short term.

But Goldman and the majority of hedge funds parted company on the oil outlook at the start of the year (“Oil price ultra-bear Goldman Sachs turns mildly bullish”, Reuters, May 16).

While the bank remained cautious about market rebalancing and warned about the possible correction in prices, hedge funds were amassing a record bullish position in futures and options in anticipation of a recovery.

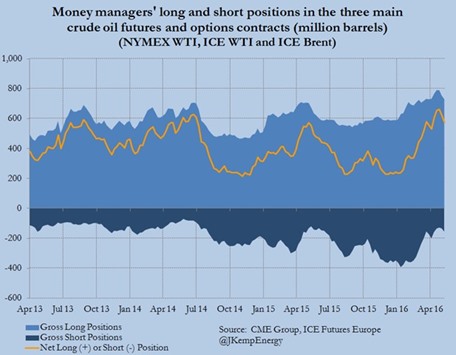

Between the start of January and the end of April, hedge funds and other money managers almost tripled their net long position in WTI and Brent futures and options from 234mn barrels to a record 663mn barrels.

Long positions anticipating a rise in prices were increased by 133mn barrels while short position expecting a price fall were cut by 208mn barrels.

In the past couple of weeks, however, just as Goldman was turning more bullish, the hedge funds have become more cautious and been taking profits following the rally.

The combined net long position in WTI and Brent was cut by 43mn barrels in the week to May 3 and a further 45mn barrels in the week to May 10, an overall reduction of almost 13%.

Most of the adjustment has come from the long side of the market, as hedge funds have locked in some of their profits, with more modest amounts of fresh shorts emerging.

The balance of forces in the oil market between supply-demand fundamentals, hedge fund positions and oil prices has become rather complicated.

As Goldman noted, the fundamental picture has become more bullish in recent weeks, with continued evidence of strong oil demand from the US and India, and a growing number of large supply disruptions.

A range of price indicators also suggest that the rally in oil prices, which appeared to have run out of steam in the first few of May, has acquired renewed drive (“Oil rally loses momentum”, Reuters, May 11).

Front-month futures prices have hit fresh highs and moved back above the 20-day moving average, suggesting that the rally has momentum.

Time spreads, which are often correlated with the supply-demand balance, have tightened again in the last week.

Refining margins, as typified by generic markers such as the 3-2-1 crack spread, have also showed renewed strength after weakening in the first week of May.

All these signals could attract more interest from hedge funds on the long side of the market.

The whole oil and products complex remains well bid, pushing more bearish traders and analysts to the margins.

But oil prices have already risen a long way from their February lows anticipating the rebalancing which is now occurring.

The concentration of hedge fund long positions continues to overhang the market, heightening the risk of a price reversal if speculators all try to exit their positions at the same time.

And the big rise in prices since the start of the year will throw a lifeline to some producers, which could delay the completion of the rebalancing process.

Overall, the risks in the oil market now appear much more evenly balanced than at the start of the year, which creates more uncertainty about near-term market direction.

In the longer term, oil prices probably have to rise further to moderate the growth in demand and incentivise more investment in supply. On the present trajectory, the oil market is headed for a big supply deficit by 2018/19.

John Kemp is a Reuters market analyst. The views expressed are his own.